Clauses of charity charter that tax authorities are most interested in

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

In this article we examine the recommendations on forming a charitable organizations’ charter which are related to the procedure of getting a non-profitable status. We had look through the general matters previously. For example, we wrote about matters of management structure, who can establish a charitable organization, which number of establishers is minimal, etc.

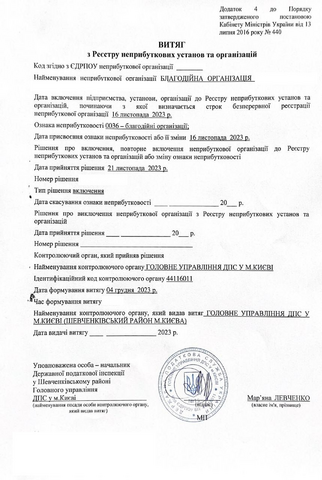

However, the most important matter is getting a non-profitable status after the registration of a charitable organization. A charitable organization can’t function without it because its profits will be taxed.

You can find detail information about the procedure of getting a non-profitable status, required documents and reasons for negative decisions in the 157 Article of the Tax Code of Ukraine and other acts which are issued by the Cabinet of Ministers of Ukraine and by the State fiscal Service of Ukraine.

The main reasons for refusal to issue a non-profitable status

Some charter’s clauses are not in accordance with the laws and it can be the main reason for refusal to issue a non-profitable status. In the most cases it is related to chapters of the charter about sources of charitable organization’s profits, the procedure of making decisions and the procedure of liquidation, using of assets.

Often the State Fiscal Service of Ukraine can demand to put in a charter some requirements to the profits’ structure and types of charitable organization’s activities which are not regulated by the laws.

That’s why we can often find words like “other” or “etc.” in these chapters. It is an infringement. So the state body will refuse to issue a non-profitable status. The 157 Article of Tax Code of Ukraine defines that corporation documents of non-profitable organizations must have a full list of types of activity.

At the same time requirements for types of profits are not so clear according to the 157 Article. Donations (money or property) and irrecoverable financial help are not tax. Also profits of the main activity are not tax. In spite the fact that the Code defines a term “the main activity”, this matter causes most of the discussions. Do publishing activity and provision of events have to be tax? The State Fiscal Service of Ukraine demands to exclude these types of activity from a charter. It also demands to rewrite all clauses on types of profits from the Code. These requirements are not lawful but it is hard to prove it practically.

The procedure of liquidation of charitable organization is the second important matter in a charter. The Tax Code tells that all assets of charitable organization must be transferred to other charitable organizations or to the state budget according to the laws on charity. The Code sends off to the article which says that assets of charitable organization must be transferred to one or more charitable organizations which are defined in a charter. It seems that the procedure of transferring can be regulated by a charter but these clauses may the reason for refusal to issue a non-profitable status. As previously, the State Fiscal Service of Ukraine demands to copy the clauses of the 157 Article.

There are other cases when a non-profitable status can be not issued but it is not possible to look through all of them in this article.

Putting changes into a charter is one of the ways to deal with this. It is related to loss of time and money. Controlling the process of issuing a non-profitable organization and representing your position correctly also can influence the decision of the state body.

We hope that our recommendation to involve lawyers to the process of registration will be more grave for You after reading our article.