General taxation system for LLC in Ukraine: advice of an accountant

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

The general taxation system is the main system, which is prescribed in the Tax Code of Ukraine (TCU). If a company is not yet on the general system of taxation, it will develop, grow and has all chances to move to this type of taxation with increasing profits.

Today we will talk about the basic things that you, as an entrepreneur, need to know about the general taxation system, and also give some advice to those who use it.

You may also like: Choosing The Best Form Of Taxation

What regulations govern the general taxation system?

When registering a company or sole proprietorship with a tax office, you automatically must pay taxes on general terms. However, you can immediately apply for the simplified taxation system. There are a number of requirements, according to which companies cannot choose any other system of taxation than the general taxation system, including:

- some types of economic activity (such as: gambling, lotteries, work with excisable goods, non-residents, etc.). This list is clearly defined by legislation;

- the annual income of the enterprise is more than 7 million per year;

- taxpayers with tax debts, both financial and documentary;

- non- resident legal entities or enterprises.

Pursuant to the Tax Code of Ukraine, taxes shall be calculated based on accounting data. In its turn, accounting is regulated by the Ukrainian Accounting Standards (UAS). It turns out that the two main documents in the accounting and taxation of enterprises operating under the general taxation system in Ukraine are the Tax Code and the UAS.

The UAS regulates the order of definition of income and expenditure of the enterprise, the order of conducting document circulation and forms of documents.

How to calculate taxes on the general taxation system in Ukraine?

In order to correctly calculate taxes on the general taxation system, it is very important to correctly determine the composition of income and to correctly determine expenses. The latter may be divided into:

- Variable expenses (such as those that are directly included in the price of the goods - raw materials, delivery and others);

- Fixed expenses (rent, depreciation and many others).

And the main task of a professional accountant is actually to correctly determine the expenditures.

You may also like: Accounting Support During The Ukrainian Market Entry

In case of the general taxation system, an LLC pays taxes, such as VAT and income tax. There are other taxes and fees, which are applied under certain conditions:

- The single social security tax – a payroll tax;

- Land taxes;

- Excise taxes;

- Use of natural resources;

- Pollution and others - under certain conditions.

The Value Added Tax (VAT) is 20% of the tax base, which is determined by Section V of the Tax Code and adjusted for “received” VAT from other payers of this tax. Corporate income tax is regulated by Section III of the TCU and is paid at 18% of the estimated profit under the UAS.

Please note! Sole proprietors can also use the general taxation system and pay tax on personal income. The calculation of such tax will be governed by Section IV of the TCU.

You may also like: How To Properly Fill In The Income Ledger?

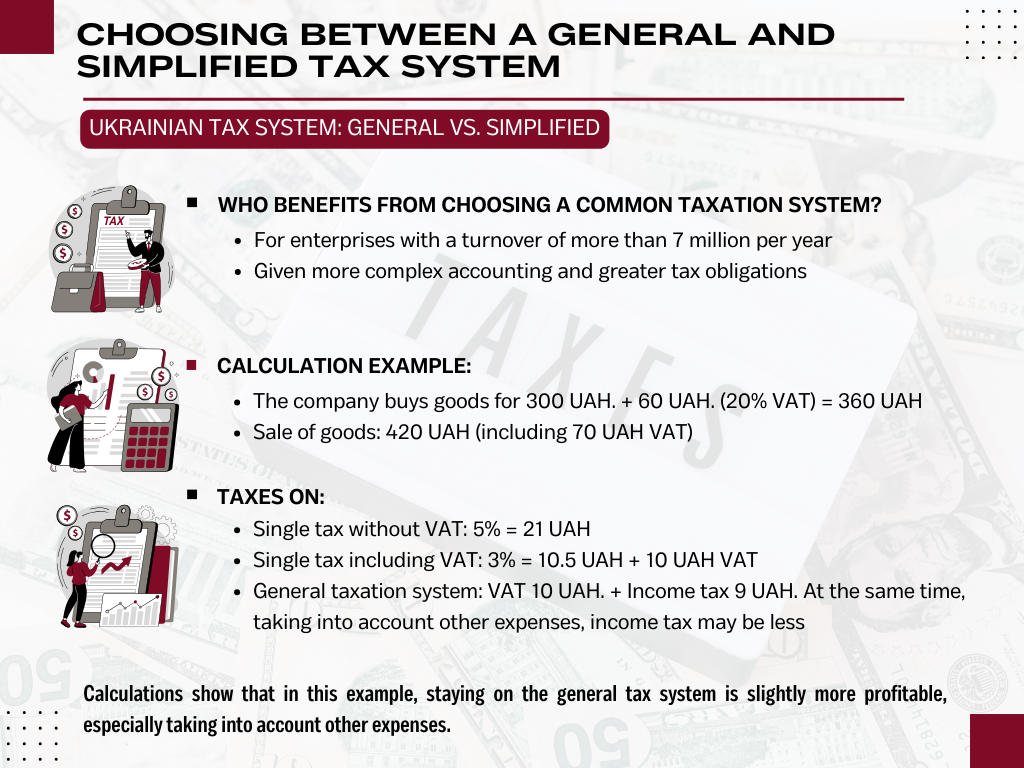

Who is to profit by using the general taxation system?

In Ukraine, apart from the general taxation system, there is also a simplified taxation system. So how to choose a system of taxation for the enterprise? If the company’s turnover is less than 7 million per year, you can also use simplified taxation system, but what do you need it for?

Let’s consider an example:

An enterprise buys goods at the price of UAH 300 per one + UAH 60 (20% VAT), the total price is UAH 360. It sells this product at UAH 420 including VAT of UAH 70 (350+70). At such figures, the taxes will be as follows:

- on single tax without VAT - 5% single tax - UAH 21;

- on the single tax with VAT - 3% single tax - UAH 10.5 and UAH 10 VAT;

- on the general taxation system - UAH 10 - VAT, and UAH 9 - income tax. In addition, income tax is reduced by other costs according to the UAS, and may become even less.

As we can see, it is a little more profitable to use the general taxation system with these figures, and this does not include fixed expenses, which also reduce income tax. But if a company provides services, then in most cases, it is better to use a simplified taxation system.

Of course, one article can hardly help to understand all the accounting and taxation principles. If you have any questions about the choice of taxation system for your business or organization of accounting of the enterprise, don’t hesitate to call us. We will gladly help you solve any issue.

We are ready to help you!

Contact us by mail [email protected] or by filling out the form: