Registration of a LLC in Ukraine turnkey

Cost of services:

Reviews of our Clients

A Limited Liability Company (LLC) is a popular legal and organizational structure in Ukraine for conducting business. The appeal of the LLC rests on the following factors:

- Versatility. An LLC is suitable for operating nearly any type of business within Ukraine.

- Convenient registration process, transition procedures, and management. For instance, changing company leadership is straightforward when needed. This process can be completed within one business day, compared to up to three days for public organizations and even a month for joint-stock companies.

- Speed and cost-effectiveness. Creating an LLC doesn't require significant initial capital or substantial startup expenses. LLC registration can be finalized within 24 hours. After registration, you can open a bank account, obtain electronic signature keys, and initiate business operations. In practice, it's possible to establish an LLC, open an account, and make all necessary preparations within 3-5 days.

When comparing an LLC with other organizational and legal forms, the most similar ones are Sp. Z.o.o (Poland), GmbH (Germany and Austria), and LLC (USA and various other countries). In essence, an LLC represents an acceptable and popular form across the majority of countries worldwide.

The process of registering an LLC is widely known. Essentially, anyone interested can readily establish a company. However, things become intriguing when the aim is not solely to register an LLC, but to establish an entire business entity. This introduces the necessity for preliminary planning, tax considerations, business structuring, and legal safeguards.

Today we will delve into the types of businesses that align well with the LLC structure and how to register it when your goal is to engage in active operations.

You may also like: What Methods Can Be Used to Form the Charter Capital During LLC Registration?

Advantages of registering an LLC in Ukraine: Which businesses should opt for this structure?

Simplified LLC Registration Process.

Registering an LLC requires a relatively modest set of documents. You can establish an LLC at Administrative Service Centres, through a notary, or even via the online platform DIIA using a model charter. With the correct preparation of the document package, LLC registration can be completed within 24 hours. Following registration, you can open a bank account and commence operations.

No Special Requirements for Founders.

Both individuals and legal entities, residents and non-residents alike, can establish an LLC. The distinction lies primarily in the document set required for registration.

Lack of Capital Requirements.

Ukrainian legislation does not impose any specific minimum capital requirement for an LLC, giving founders the autonomy to decide this aspect themselves. We recommend our clients select a capital amount that aligns with their capacity for investment and the initial needs of their business.

Liability.

An LLC assumes individual responsibility for its actions or inactions. Participants within the LLC are accountable within the limits of their contributions. In essence, even in the scenario of liquidation, your exposure is confined to your invested capital.

Operations and Licensing.

LLCs encounter no limitations concerning the spectrum of activities they can engage in, thereby providing an excellent avenue to acquire a majority of licenses and permits.

The LLC stands as a remarkably versatile business structure in Ukraine, enabling the procurement of many essential licenses and permits. Exceptions are present for specific business sectors that demand adherence to particular organizational and legal forms.

For instance, industries like banking necessitate the establishment of joint-stock companies. However, with the LLC format, you can obtain permissions for construction, licenses for transportation, medical practice, security operations, and more.

Taxation.

An LLC can fall under the general tax system, opt for a unified tax regime, or become a VAT payer.

For instance, if a business is in its initial stages and there's uncertainty about the anticipated turnovers for the year, we recommend considering the simplified tax regime with an annual cap of up to 7.8 million. However, in specific cases, opting for the general tax system along with VAT might be more suitable.

Legal Regulations.

As the most popular organizational and legal structure, an LLC sees continuous updates in legislative regulations that govern its operations.

For many years now, an LLC has remained the optimal choice for a wide range of businesses in Ukraine. By adopting an LLC, you can establish an IT business, a security agency, an information service, engage in construction, offer various services, explore the advertising realm, or venture into the hospitality sector – virtually any field is accessible.

Exceptions apply to a small percentage of businesses where legal requirements mandate a different organizational and legal structure. For instance, banks or corporate investment funds are required to adopt the legal structure of a Joint-Stock Company.

You may also like: How Can a Foreign Company Establish Their IT Business in Ukraine?

Procedure and Stages of Registering an LLC in Ukraine

The registration process for an LLC encompasses the following stages:

Preparatory Stage

Before initiating document preparation and the registration process, our legal experts delve into understanding the nature of the LLC's intended operations. They may recommend including supplementary types of activities and conducting a thorough check on the chosen company name. If the desired name is already in use, registering an LLC with the same name becomes unfeasible. In such instances, we propose minor adjustments to the name.

For example, a client might be advised to incorporate "plus" or "1" into the name, and we can handle the registration process smoothly.

We also gather details about other aspects such as the address, the amount of the registered capital, etc. Typically, at this stage, clients complete a questionnaire, and we align the information and documents provided by them.

Preparation of Document Package for LLC Registration.

After confirming all the details, we move on to assembling the necessary documents for official registration, which include:

- Charter: This document must be notarized. While a standard charter is acceptable, some clients prefer a custom-made charter tailored to their specific requirements.

- Resolution/Minutes: A written form is sufficient for registration purposes.

- Ownership structure diagram.

- Registration Form: Our legal experts will complete this form.

Accompanying these documents are instructions (if the documents are signed on behalf of and by the founders), a passport (notarized copy) of the ultimate beneficial owners of the legal entity, and any additional documents that might arise during the process.

Registration of the LLC with the State Registrar or a Notary.

We submit the document package and proceed with the LLC registration process.

After the registration is complete, we provide the client with:

- Charter

- Resolution/Minutes

- Description

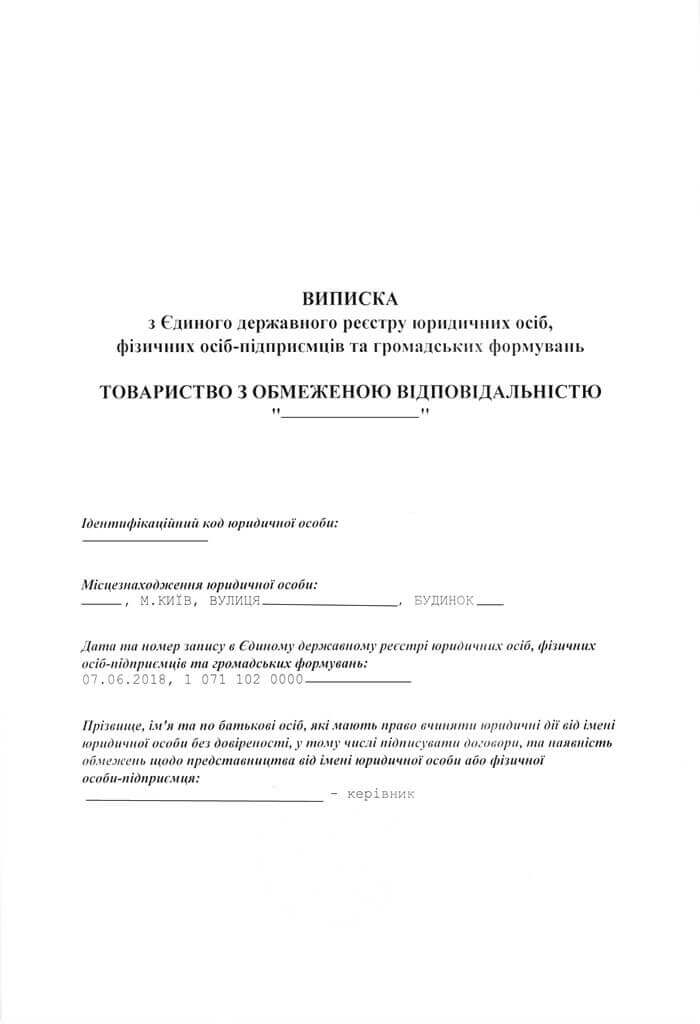

- Extract

- VAT/Unified Tax Registry Extract (if applicable).

You may also like: LLC Registration Based on Founder's Domicile in Ukraine

What to Do After Registering an LLC?

Following the successful registration of an LLC, the subsequent steps are as follows: an electronic digital signature (EDS), a bank account, and a company seal.

An Electronic Digital Signature (EDS) is a modern and highly convenient method that offers a range of possibilities for efficient management with minimal time investment.

An EDS allows you to:

- Access the electronic taxpayer's portal;

- Submit tax reports to tax authorities through the electronic portal;

- Electronically sign documents, including contracts;

- Make use of specific services and registries.

You can obtain an EDS from any accredited key certification center or from a bank that provides such a service.

Bank Account. The comprehensive functioning of a business initiates with the establishment of the company's bank account. This account can be opened at any bank across Ukraine.

A bank account empowers a legal entity to carry out diverse financial operations, encompassing receiving payments from clients, executing payments to partners, disbursing employee salaries, and other transactions integral to their operations.

Furthermore, it ensures convenience and efficacy in managing financial undertakings. A legal entity can seamlessly monitor its financial flows via banking services like electronic payments, online banking, automated transfers, and more.

In essence, the act of inaugurating a bank account for a legal entity within Ukraine bears significance due to pragmatic, legal, and business-driven rationales.

Upon securing an account, you acquire a fully operational Limited Liability Company, acting as the machinery for accomplishing your aspirations.

Nevertheless, it's prudent to acknowledge that opening a bank account can at times be intricate, owing to banking surveillance and oversight.

To illustrate, recently, we facilitated the launch of an account for a company entirely owned by a non-resident. During the account inception, the bank sought certain supplementary clarifications. We gathered and presented the requisite particulars to the bank, thereby aiding the client in the successful initiation of the account.

Company Seal. The next stage encompasses the creation of a company seal. This step is at your discretion, as it is not a mandatory legal requirement. To proceed, you can engage with specialized establishments that handle the fabrication of seals. They can craft a seal within one day.

Choosing the Optimal Taxation System for an LLC

A crucial step in establishing an LLC is determining the most suitable taxation system and carrying out the necessary registration with tax authorities. Within a single day following registration, the tax agency will include the LLC in its official records.

During the registration process, the LLC can elect to adopt the simplified taxation system or voluntarily acquire VAT payer status. If a client possesses a clear understanding of the requirement for either Unified Taxpayer or VAT status, we submit the appropriate application during the formation of the LLC.

- The general taxation system implies an 18% tax on profits, with the taxable base calculated using the concept of taxable income.

- The simplified taxation system presents two alternatives: Group 3 with a 5% tax rate or Group 3 with a 3% tax rate with VAT. The taxable base is rooted in the total income.

An LLC has the option to operate within either the general taxation system or the simplified taxation system. The decision on which taxation system to adopt hinges on a multitude of factors that need to be taken into careful consideration.

To illustrate, we recently undertook the registration of an LLC for IT services. In this scenario, it made more practical sense to select the simplified taxation system, given that the projected annual income would not surpass 0,000. However, for a different IT company engaging more than 20 employees, the simplified system would not be a suitable choice due to its limitations.

If you have expenditures related to raw materials, contractors, payroll, rent, and interest on loans—expenses that constitute a substantial portion of your earnings—it would prove more advantageous to opt for the general taxation system. In such instances, the basis of taxation would be the taxable income, derived as the difference between income and expenses, while accounting for the specifics delineated by the Tax Code of Ukraine.

If your expenses are kept to a minimum, it's best to consider the simplified taxation system. Under this approach, you'd be paying a fixed tax rate or a percentage based on your total income. However, it's worth noting that the percentage rate for the simplified taxable system is significantly lower than that of the comprehensive system.

Please note! Not all types of economic activities are eligible for the simplified taxation system.

You'll also need to decide whether voluntary registration as a VAT payer is appropriate.

If a substantial portion of your expenses is tied to procuring services or goods from VAT-contributing entities, and if your clientele predominantly comprises VAT contributors, it's wise to voluntarily enroll as a VAT contributor. This arrangement would empower you to apply the paid VAT to a tax credit and leverage it in the future or seek reimbursement from the budget.

Furthermore, cooperation with non-VAT payers is disadvantageous for your counterparts who are VAT payers.

For instance, we recently facilitated the registration of a transport and logistics enterprise slated to partner with major supermarket chains and international collaborators. Naturally, for the operational framework of such an enterprise, opting for VAT and embracing the comprehensive taxation system would be the more advantageous route.

You may also like: Is Apostille Required for Foreign Passport Copies During LLC Registration?

Why is it crucial to plan the operations of an LLC in advance?

For our corporate clients, we propose a comprehensive business planning process even prior to initiating the registration procedures. This planning typically encompasses:

- Analyzing the client's intentions and aspirations with respect to their activities in Ukraine, examining their feasibility in accordance with Ukrainian legal frameworks.

- Scrutinizing the client's situation or proposed strategy and presenting viable alternative approaches.

- Constructing plausible scenarios aimed at attaining the client's objectives, taking into meticulous consideration the nuances of their individualized plan.

- Providing legal counsel in terms of the most advantageous course of action for the business, backed by a rationale explaining why a particular option is poised to yield the desired results or highlighting potential risks for the client should they opt for a specific avenue.

Planning the operations of an LLC in Ukraine is a crucial stage in effective business management. It involves the development of both strategic and tactical plans for the company's activities with the ultimate goal of achieving its objectives.

Here are several compelling reasons why planning an LLC's operations holds significant importance:

Clear Objective Setting: Planning allows for the establishment of precise goals that the company strives to attain. These goals could encompass financial metrics, market positions, the introduction of new products, or business expansion. Defining objectives helps focus the team's efforts on achieving specific outcomes.

Optimal Resource Utilization: In order to realize the predetermined goals, planning the LLC's operations allows management to identify and allocate necessary resources – be it financial, human, or material. This ensures that resources are distributed efficiently, minimizes the risk of shortages or wastage, and guarantees that resources are utilized optimally across all sectors of the company.

Anticipating and Adapting: The act of operational planning entails analyzing market trends, gauging competition, staying attuned to shifts in consumer preferences, and considering other pertinent factors that could influence the LLC's operations. This comprehensive outlook equips the company to adjust its strategies in response to changes in the external landscape, thus securing a competitive advantage.

Risk Management: Planning the operations of an LLC serves to identify potential risks and devise strategies for their effective management. This can encompass risk prevention, minimizing their impact, or creating contingency plans. Proficient risk management plays a crucial role in upholding the financial stability and dependability of the company.

Employee Motivation: Clearly outlined goals and strategies within the operational plans offer the company's team a well-defined trajectory, illustrating how their endeavors contribute to realizing these goals. This can ignite and sustain employee motivation, ensuring purpose-driven actions.

Operational planning for an LLC in Ukraine is a requisite for competent business governance, ensuring constancy, goal actualization, and adaptability in response to market fluctuations. It empowers leadership to make well-considered decisions and oversee the company's evolution.

If you're considering launching a business in Ukraine, don't hesitate to reach out to us!

All services under one roof – convenient, reliable, and tailored specifically for you.