Non-profit status of NGOs in 2016. What's new?

Why have we written this article about non-profitable status?

Laws which regulate activity of public associations have been changed notably during last years. But only now public associations, charitable funds, cooperatives and other types of non-profitable organizations which don’t follow the last changes can get real difficulties on their activity.

First of all it concerns a non-profitable status which allows all non-commercial organizations to get profits and not to pay corporation tax.

Recently adopted acts by the Cabinet of Ministers of Ukraine demand to put changes into organizations’ corporative documents for non-profitable status. Organizations must put changes until the first of January 2017.

We will tell you about changes in laws and give some practical advice for heads of organizations in this article.

Changes which regulate a non-profitable status

According to execution of the Law of Ukraine no. 652 dated the 17th of July 2015 “On putting changes into the Tax Code of Ukraine about taxation procedure of non-profitable organizations ” , the Decree of the Cabinets of Ministers of Ukraine no. 440 dated the 13th of July 2016 defined the procedure of inclusion non-profitable organizations on the Register of non-profitable organizations.

We need to admit that these laws are the main acts in this sphere. The law has defined requirements for non-profitable organizations which they must fulfill. The Decree has defined the procedure of fulfilling requirements and there are clauses about deprivation this status from commercial organizations.

So there is the list of criteria for getting a non-profitable status:

- established and registered according to the laws which regulate non-profitable organizations’ activity;

- organization’s incorporate documents must have prohibition of distribution of profits or their parts among establishers, members, members of management, workers (except their salaries and Single Social Contributions) and other persons;

- organization’s incorporate documents must have clauses about transferring NGO’s property to one or more similar non-profitable organizations or transferring property to a state budget in a case of liquidation (merger of organizations, division of organizations, affiliation or reformation of organizations);

- using all organization’s profits only for realization non-profitable organization’s targets according to its charter.

The Decree has the same list and defines the procedure of bringing documents in accordance with this list.

How these changes will be realized practically

According to the Decree, the State Fiscal Service of Ukraine must send written requests to non-profitable organizations which were included on the Register during two months since the moment when this law comes into force. After it organization must submit information about its charter whether it has requirements according to 133 article of the Tax Code. These requests won’t be send to organizations which charters are published online via official resources and have requirements according to 133 article of the Code.

The term for the answer is one month. At the same time organization must bring its charters in accordance with the new law and report about it State Fiscal Service not later than the 1st of January 2017.

The state body examines received documents according to 133/4 article of the Tax Code of Ukraine during a month since the moment when they had been got.

In order to it state body can:

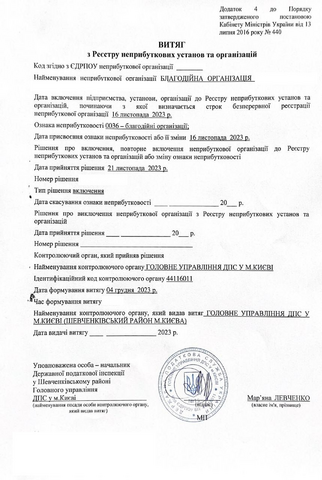

- include non-profitable organization on the new Register;

- send a notice to non-profitable organization about unconformity to the article.

But pay attention that organization won’t be excluded from the Register until the 1st of January 2017 even if charter doesn’t comply to requirements. It is a minimal term for organizations to put their charters in accordance with the new law.

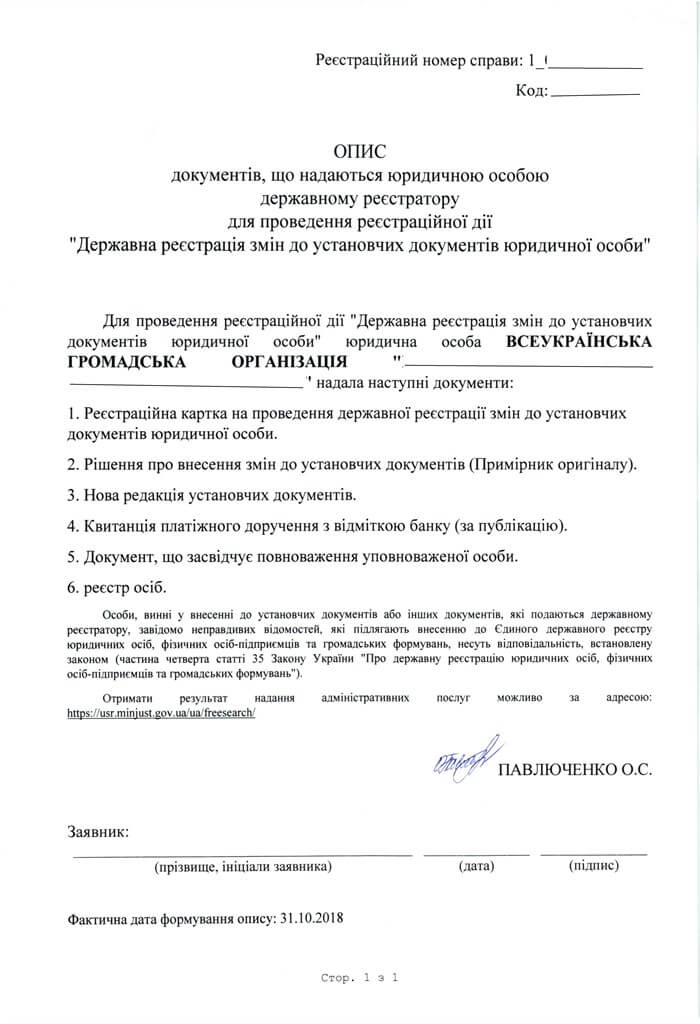

Non-profitable organization must put its charter in accordance with the law if organization was informed with the notice. That’s how it can be included on the Register until the 1st of January 2017. There are also clauses which demand to report about charters’ changes to the State Fiscal Service of Ukraine. Organizations must submit an application form with a mark “changes” and copy of charter. An application form and copy must be submitted during 10 working days since the moment of changes’ registration.

According to these documents State Fiscal Service of Ukraine makes a decision about the second inclusion to the Register, about change of non-profitable code or about refusal of inclusion to the Register.

The procedure of the exclusion

The act defines a full list of exclusion cases:

- using non-profitable organization’s profits not for realization targets which are regulated in a charter;

- division of non-profitable organization’s profits or part of them among establishers, members, workers (except salaries and taxes), management etc;

- clauses of a charter are not in accordance with the 133.4 article of the Tax Code of Ukraine;

- approval of a liquidation balance, a transfer act or distributing balance of organization which is mergered, divised, affiliated, reformatted or liquidated;

- a decision of non-profitable organization to stop its activity.

Exclusion is realized through the procedure of cancellation non-profitable code.

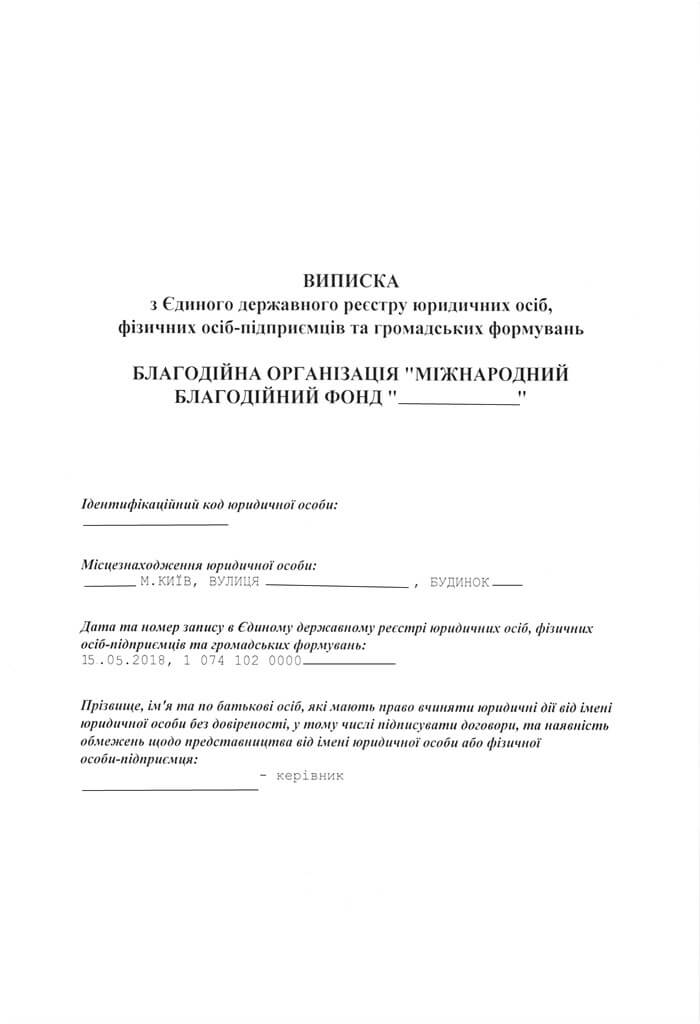

State Fiscal Service of Ukraine also has a right to put changes into identification and registration information of organization which can be taken from the Unified State Register of legal entities, individuals and public associations. If there are reasons for changing non-profitable code then information about it is included into the Register and issued decision about change of non-profitable code.

Conclusions and recommendations about procedure of conformation a non-profitable status in 2016

Non-profitable organizations which are included to the Register of non-profitable organizations and informed about putting their charters in accordance with 133.4 article will be excluded from the Register in a case of not submitting copies of charters to the state bodies until the 1st of January 2017.That’s why we recommend to non-profitable organizations don’t wait for notices from the state bodies and look through their charters and make conclusions by themselves. It will be not excessive to submit documents to the State Fiscal Service of Ukraine until the 1st of January 2017. So organization will save time and find out if its documents are complied with the law.

Our clients