Regulations on activities of non-profits in Ukraine in 2016

Cost of services:

Reviews of our Clients

Regulation of non-profitable organizations’ activity

Development of constitutional state is possible only if a civil society exists. Public associations occupies a special place there. For protecting its own rights and interests and rights of its members public associations need some law consultations and help sometimes. First of all, it related to changes on public associations’ activity in laws.

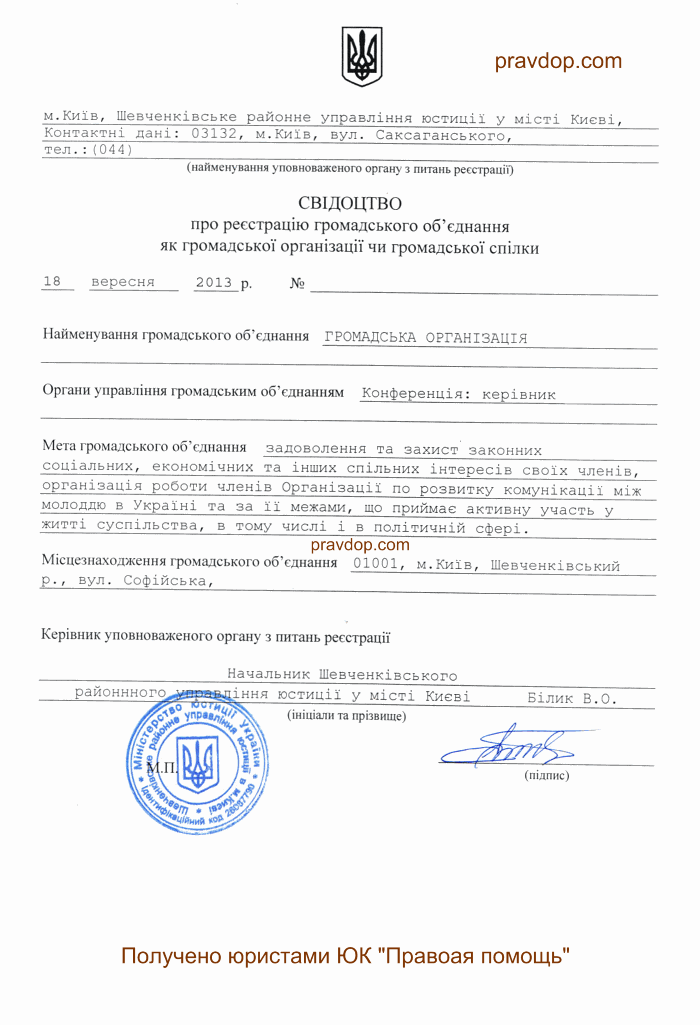

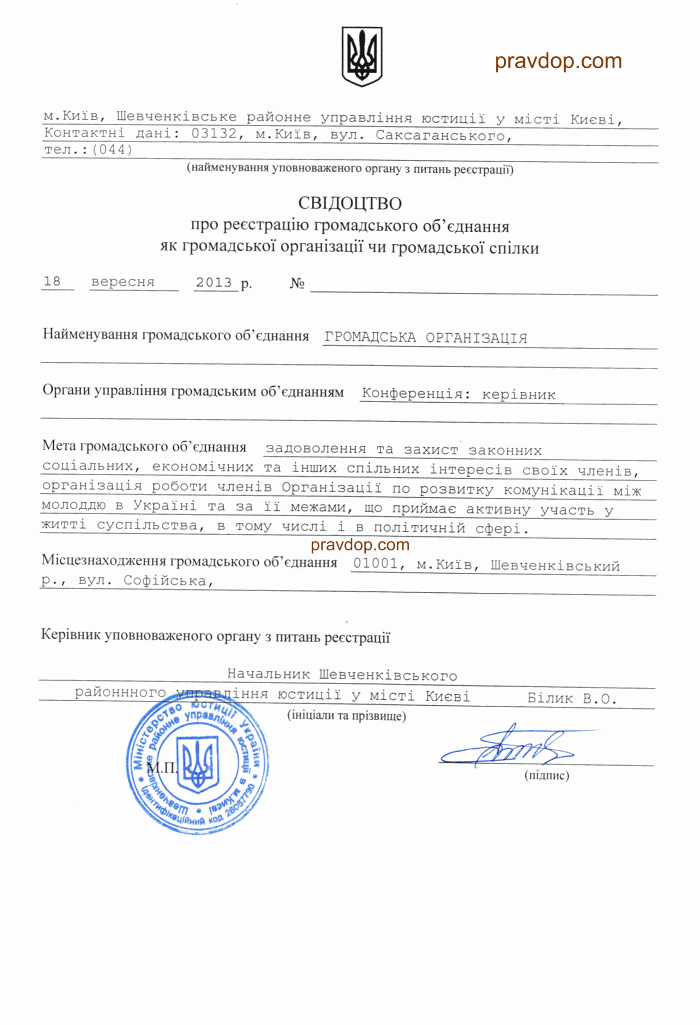

The main law of this sphere is the Law of Ukraine “On public associations” (hereinafter – the Law). The Law came into force on the 1st of January 2013. Clauses of previous Law of Ukraine “On association of citizens” , dated 1992, which had regulated activity of public associations until 2013, were recognized undemocratic by European Court of Human Rights in 2008.

Previously our lawyers have written a detail description about main novelties on activity and procedure of registration which are introduced by the Law.

It’s important to admit that new requirements are not used for public associations or unions which had been registered before, until the moment of taking decisions about name change or about registration of legal entity. It means that old name may not be changed if it is required to type of public association until public association will take a decision on its name change by itself. In general, this article will related to hundreds of public associations which names have words such as a “committee”, “agency” or have parts of companies’, institutions’, organizations’ or individuals’ names which were used without their permission. Considering hundreds of associations which have identical or similar names with state bodies in Unified State Register, these clauses of restrictions are reasonable. It’s unlikely that citizens can distinguish this public association from state body of Ukraine.

We can add some comments to the principles of public associations’ activity. The principle of equality and principle of equal rights of members were disappeared. The Law defines such principles as a principle of voluntary, a principle of self-government, a principle of exterritoriality, a principle of equality before law, a principle of lack of members’ property interest, a principle of transparency, a principle of openness, a principle of publicity. There are also legal explanations for every of them and this matter is important for legal practice.

In general public associations are non-profitable. This matter is regulated by the Tax Code of Ukraine (hereinafter- the Code). The procedure of non-profitable organizations’ taxation has been changed since the 1st of January 2015 according to the Law of Ukraine “On putting changes to Tax Code of Ukraine and other laws according to the tax reform” dated the 28th of December 2014. We had explained this previously. But those changes can be considered as unsuccessful. Because 133 article of the Code was changed again according to the Law of Ukraine no. 652 - VIII dated the 17th of July 2015 in the middle of 2015. There was defined a new edition of term “a non-profitable organization”.

|

Previous term (14.1.121 of the Code) |

Actual term (14.1.121 of the Code) |

|

Non-profitable organizations – are companies, institutions, organizations which have a target not to get a profit but to do charity, patronage and other activity according to the law. |

Non-profitable organizations – are companies, institutions, organizations which are not payers of corporation tax according to 133.4 article of the Tax Code of Ukraine. |

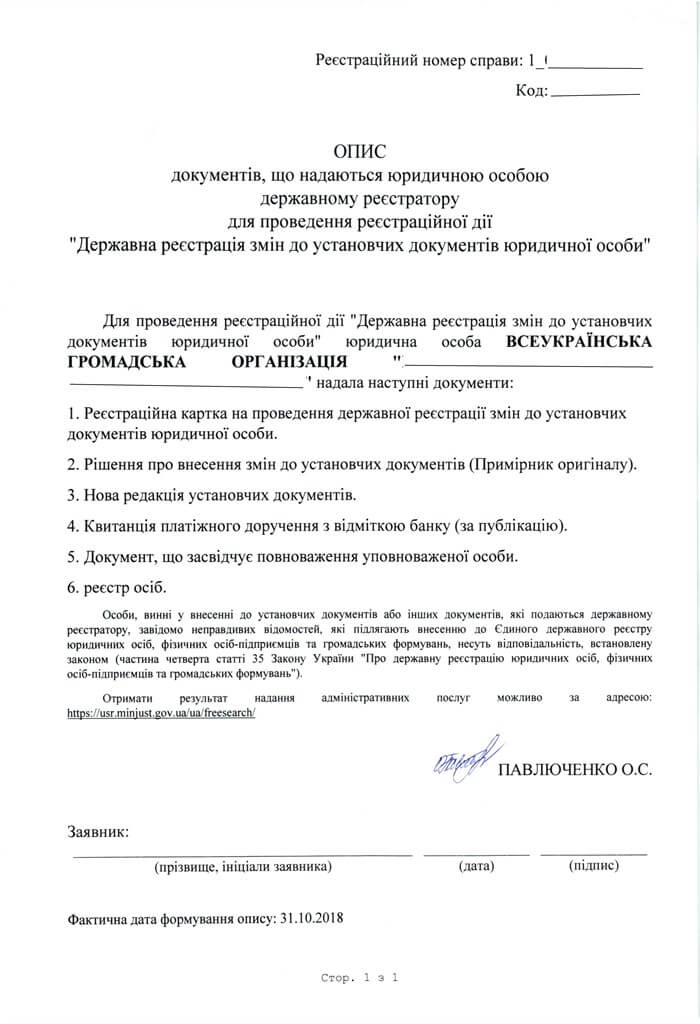

The Law of Ukraine no. 652 – VIII has a new article no. 133.4 which is regulated criteria of getting non-profit status. According to this article organization must have such requirements:

- to be established and registered according to the laws which regulate non-profitable organizations’ activity;

- organization’s incorporate documents must have prohibition of distribution of profits or their parts among establishers, members, members of management, workers (except their salaries and Single Social Contributions) and other persons;

- organization’s incorporate documents must have clauses about transferring NGO’s property to one or more similar non-profitable organizations or transferring property to a state budget in a case of liquidation (merger of organizations, division of organizations, affiliation or reformation of organizations);

- organization must be included on the Register of non-profitable organizations.

Also the list of non-profitable organization was concretized. According to 133.4.6 article of the Code and to 133.4 article non-profitable organizations can be: budget institutions; non-governmental organizations, political parties, religious organizations, charitable organizations, creative unions, pension funds; unions and other associations of legal entities; housing-constructive cooperatives (beginning with the first date of month when construction was finished and cooperative buys this house), countryside cooperatives (counry-constructive), gardening and garage cooperative (garage-constructive); associations of owners of apartment buildings, associations of owners of private houses; professional unions and their associations, associations of trade unions, organizations of employees and their association; agricultural cooperatives and their associations; other legal entities which do activity according to 133.4 article of Tax Code of Ukraine.

But you should also remember that it’s not enough to be in this list. Organization must have requirements according to 133.4.1 article.

Non-profitable organizations must submit reports about using their profits according to the procedure which is defined by the law no. 652. The reports must be submitted in time. The main task of it is controlling exes. If profits are used against targets of organization then organizations must pay corporate tax and be a tax payer. That’s why if organization gets profits from non-charter activity and doesn’t use it for charter targets then it must submit report about using these profits during a month according to 133.4.3 article of Code. Report must have information about period from the beginning of the year until the date when infringement was committed. At the same tax obligation is calculated in order to amount of money which were used not purposefully. This non-profitable organization is excluded from the Register of non-profitable organizations.

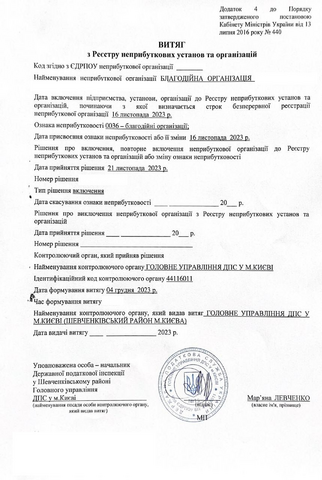

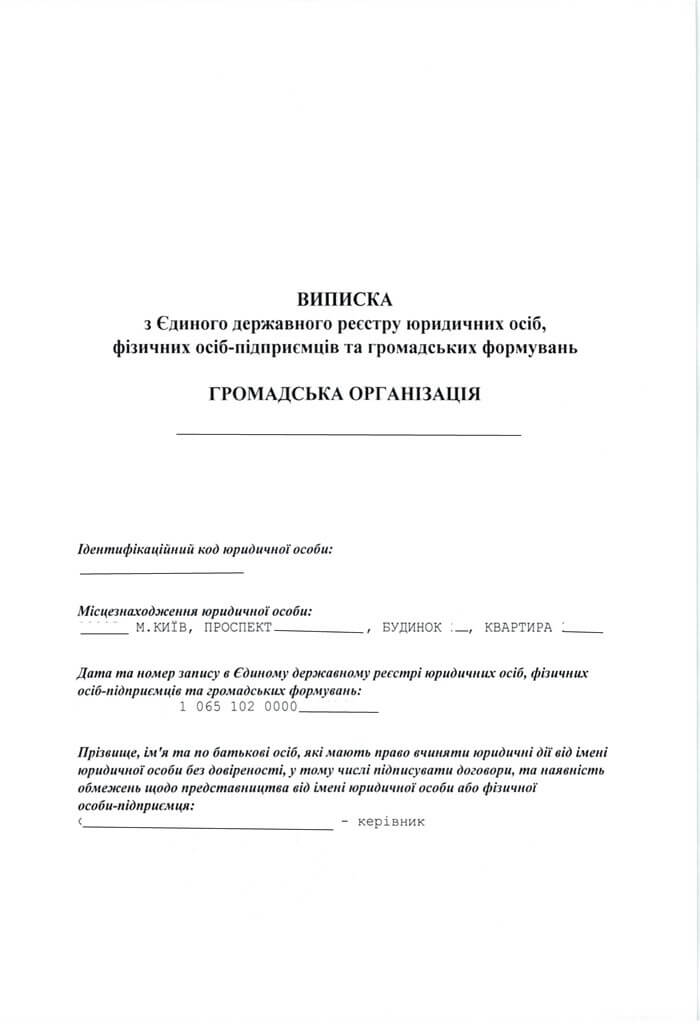

Changing of non-profitable characteristic and keeping non-profitable status is a topic matter today. There is a new procedure of inclusion on the Register according to the Decree of Cabinets of Ministers of Ukraine no. 440 dated the 13th of July 2016.

We had written an article about it.

There was an old procedure which was approved by the Order of the Ministry of Finance of Ukraine no. 37 dated the 24th of January 2013. But the new procedure must be in accordance with 133.4 article of the Code which regulates terms of being non-profitable organization.

The advantages of new procedure:

- action algorithm of non-profitable organizations and control bodies during inclusion and exclusion from the Register;

- characteristics of being in the Register, organization’s inclusion and exclusion from the Register;

- a structure of non-profitable codes was changed.

Comparison of a new structure and an old structure according to the Order no. 37

|

New non-profitable cods which are defined by 4 article of the Decree |

Non-profitable cods according to the Order no. 37 |

||

|

(0032) |

Public associations |

(0006) |

Public organizations which are established for the rehabilitation, sports purposes and social services for disabled people; for legal support, ecological, wellness, amateur sports, cultural, educational and science activity; public associations of disabled people, unions of public association of disabled people and their local chapters which are established according to the law |

|

(0035) |

Religion organizations |

(0013) |

Religion organizations which are registered according to the law |

|

(0036) |

Charitable organizations |

(0005) |

Charitable funds (organizations) which are established according to the law |

|

(0038)

(0039)

(0048) |

Unions

Associations and other organizations of legal entities

Other legal entities which have requirements according to 133.4 article of the Code and established and registered according to the law |

(0012)

|

Unions, associations and other organizations of legal entities which are established for representing interests of founders (members), kept for their contributions and don’t do business except getting passive profits

Other legal entities which don’t get profits according to the law |

- According to the new Decree you mustn’t go to the State Fiscal Service of Ukraine by person. You can submit an applicant form for getting non-profitable status online.

- There is a term of getting a decision – 14 days. The content of an application form reducing four times (it’s one page now).

- The amount of information is increased and access to the Register is opened. The Register is consisted of identification and registration information of non-profitable organizations. Unlike previous Order there is no obligation to display information about organization’s location, chiefs, chief accountants, founders, economical information which are characterized financial indicators of non-profitable organization’s activity. The Register of non-profitable organizations is open and available for everyone via web-site of the State Fiscal Service of Ukraine.

As follows this Decree provides execution of 133.4 article of the Code and support regulation of disputes between the State Fiscal Service of Ukraine and tax payers during using clauses of the Tax Code of Ukraine on taxation of non-profitable organizations.

Our clients