Accounting in a restaurant or cafe: what are the features and how to organize it correctly?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

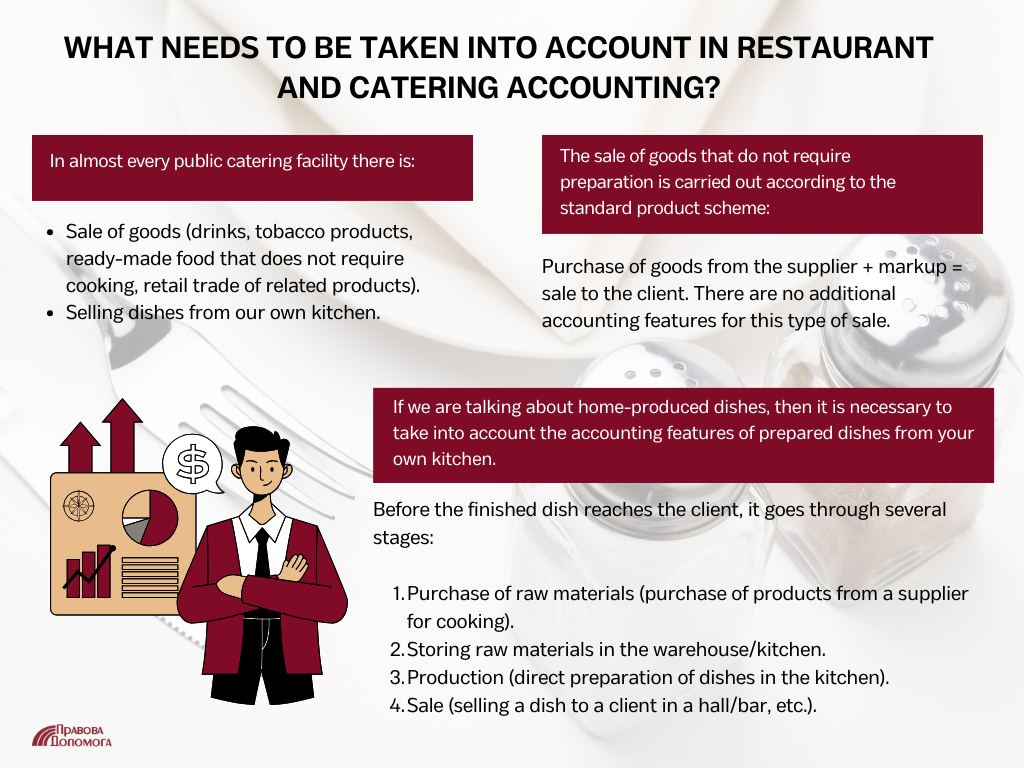

In some business activities, accounting is clearly regulated by law and there is no need to invent or optimize anything. But in the case of catering business, restaurants, cafes, accounting is quite time-consuming, and requires a careful and creative approach. It raises questions about a cash register, excise goods, such as alcohol, storage and write-off regulations, aspects with the sanitary epidemiological station, and much more.

What taxes should a restaurant pay, and what should be taken into account when organizing accounting at a restaurant? Today we will answer all these questions.

Alcohol sales accounting: What tax shall be paid when selling alcohol?

An important role in accounting of restaurants and cafes is played by alcohol. When selling or distributing alcohol, you must register as a taxpayer on general terms. This system of taxation implies payment of income tax at 18% of net income minus expenses, which is often less profitable than the single tax.

In addition, when you achieve a turnover of 1 million, you must register as a VAT payer. And this is an “additional” tax of 20%. Read more about when and how to switch to VAT here.

Today, there is a scheme, when a restaurant or cafe selling alcohol registers 2 business entities:

- A business entity (a sole proprietorship or LLC) operating under the general taxation system, with the sale of alcohol through the mandatory cash register;

- A business entity, which is engaged only in catering. This does not require a license, and you can use a single tax, subject to other conditions.

Such business entities enter into a joint venture agreement and jointly lease premises. Let’s talk about the possibility of implementing such a scheme in more detail.

Two business entities in a restaurant: Food separately, alcohol separately

In such a situation, the restaurant will be actually divided between several business entities. This increases the labor intensity for accountants, but significantly reduces the amount of taxes.

How to organize accounting in such a situation? Here are some aspects worth remembering:

- All sales (orders) of alcohol shall be registered with a business entity using the general taxation system.

- You must register cash registers with correct encoding.

- Income tax shall be calculated as follows: the purchase price of a sold beverage and other fixed costs (rent, salary and other costs necessary for business activity) are deducted from the amount received from the sale of alcohol for the month. The resulting difference is to be paid at 18%.

- Reporting and payment of income tax shall be made annually.

- Once the sales amount exceeds one million for a year, an application for registration as a VAT payer must be submitted. After registration, VAT on sales must be taken into account: VAT must be taken from the purchase amount (if a taxpayer bought alcohol) and the difference must be paid to the state budget. For example, the sale of alcohol amounted to UAH 360, including 20% VAT of UAH 60. Purchase UAH 300 + VAT (UAH 50).The amount to be paid to the state budget is UAH 10. Submission of reports and VAT payment shall be made on a monthly basis.

You may also like: Accounting Support Of A Business Entering The Market

Food accounting: Taxation of restaurant cuisine

The other side of the restaurant is its “cuisine”. It includes food, soft drinks, beer and table wine. For this type of activity you can register a business entity on a simplified taxation system - a single tax.

The maximum annual turnover for the 2nd group is 5 million. The tax rate amounts to 20% per month of the minimum wage established on January 1 of each year.

Most often business entities engaged in restaurant business choose the 3rd group of the single tax. It allows the higher turnover - more than 7 million, and does not not provide for any limitations for the number of hired employees, and the form of ownership can be both a sole proprietorship and LLC.

The tax rate for Group 3 is 5% of the turnover (if you don’t want to register as a VAT payer).

You may also like: How To Start A Restaurant? Legal Advice

Please note! In cafes and restaurants, payment is often made in cash; accordingly, when the turnover reaches 1 million, you must register and use a cash register, according to the law. And since January 1, 2021, the cash register is mandatory without reference to the turnover of a business entity.

If you want to make head of taxation issues of your business, don’t hesitate to call us. We will not only provide you with professional advice, but also take care of the full accounting of your company.

Didn’t find an answer to your question?

Our clients