Personnel accounting and work with employees in representative offices

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

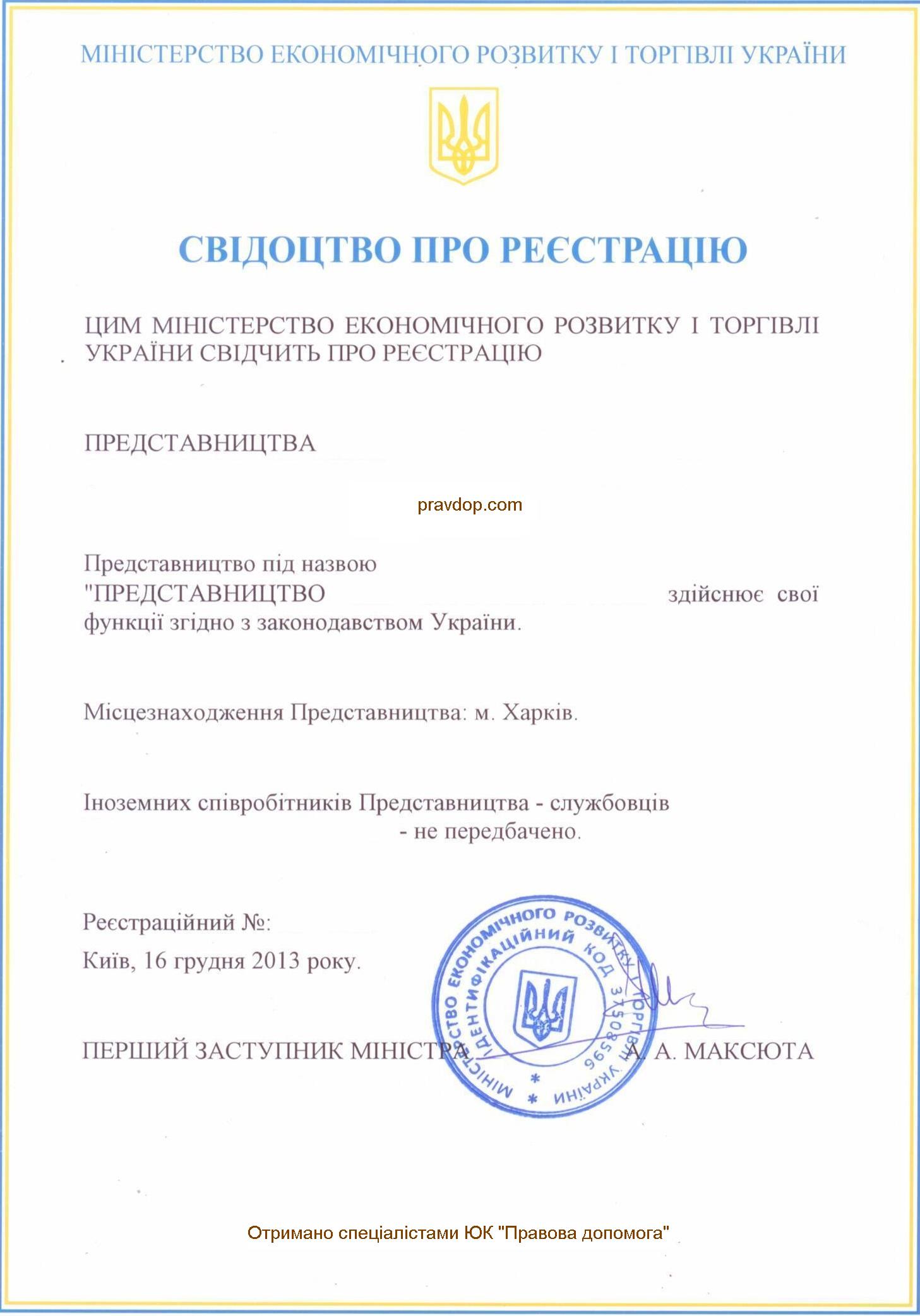

A representative office of an economic entity is not a legal entity and does not carry out independent economic activity. In all cases, it acts on behalf of and upon the instructions of a foreign economic entity. However, in addition to its main activity, there are also a number of mandatory ones.

Not all representative offices are prepared to handle the complexities of bookkeeping and accounting, especially when dealing with a foreign workforce. This requires familiarity with Ukrainian tax laws and navigating local bureaucratic processes. It's not just about business, but also the routine administrative tasks that must be managed.

To make processes easier, minimize accounting costs, avoid fines, and get timely advice on important questions, there are companies like ours that are ready to do this work professionally and with guarantees, providing several advantages:

- You won't need to set up one or several working spaces for an accountant in your office, as this is usually not economically feasible.

- You'll have a personal client manager who is always available during work hours.

- We offer comprehensive and speedy solutions to your queries, giving you the feeling that there is no "distance" between you and your accountant.

- We are highly professional and efficient.

- There is no need to hire, adapt to corporate structures, or monitor anything.

A company that provides accounting services is responsible for timely and accurate documentation and financial calculations. This means that bills and taxes can be paid on time and you can forget about accounting for a while. You'll receive the results of our work easily, through messages from your client manager and confirmation in the form of documentation.

You may also like: How to Employ Staff in a Foreign Representative Office?

What does personnel accounting involve in a foreign representative office in Ukraine?

The personnel and accounting records of a foreign representative office in Ukraine consist of various operations and processes:

- Maintaining records of employees by profession and position, from hiring to career advancement;

- Calculation of salaries for foreign employees and citizens of Ukraine;

- Submission of payroll reports;

- Preparation of financial statements;

- Preparation of payment orders for the bank;

- Calculation of sick leave;

- Keeping records of vacation time;

- Preparation of staffing schedules;

- Preparation of orders for hiring, firing, or transferring employees to another position;

- Internal, tax, and financial audits;

- Consultation assistance and analysis of the representative office's activities.

Typically, personnel recordkeeping in Ukraine for establishments or representative offices involves:

- Maintaining personnel files and personal records;

A personal card is created for each employee, even for those who work part-time or are engaged for temporary work. The cards contain general information such as contact details, full name, qualification information, residence, family status, and family composition, etc.

Additionally, during the collaboration, information about the employee's "path" in the representative office is recorded in the card – termination, hiring. All data is filled in based on the order of hiring and/or transfer.

Please note! The employee must read and sign the card.

It shall indicate all types of leave that are provided to the employee during their work, along with dates.

Keeping a military record if the employee is a conscript or reservist is also a crucial aspect.

It should also keep track of the professional education that the employer pays for.

- Maintaining books/journals to record orders related to the personnel;

All personnel orders must be registered, whether it is about hiring an employee or granting them leave.

Recording the date, order number, and contents of the local act ensures optimization and enables control.

- Keeping track of staff leave balances;

To do this, you should create a vacation reserve - a sum planned for the year to pay for both annual and additional vacations, in accordance with the legislative requirements.

This reserve must be created once a year. If not all employees use their right to vacation, and there is an excess in your balance, it becomes income at the end of the year's inventory.

- Maintaining employment records and a logbook of the movement of employment records;

The first page of the record book contains information about the employee and their personal signature.

All entries about hiring, transfer to another permanent job, or termination, are made within a week of issuing the order, or on the day of termination, and must comply with the text of the order.

Recently, it has been stipulated that employers are not required to keep the employment records of newly hired employees on-site. Instead, the employees who provided their employment records have them returned to them for signature after the information has been entered into the State Register of Mandatory State Social Insurance.

You may also like: What Taxes does a foreign Representative Office Pay?

HR management as part of support services for foreign representative office

Personnel management, working with employees in terms of their employment or dismissal, is just one part of the accounting work that will be carried out at a foreign representation.

When working with our Clients, we offer comprehensive legal support for the activities of a foreign representation. This work scheme includes the work of a team of a lawyer and an accountant, who together ensure the safety of your activities in Ukraine.

Our work involves:

- Keeping accounting records and working with the accounts of the representation.

- Assistance of a lawyer in the work of an accountant.

- Assistance in resolving personnel issues, including the development of employment contracts for the necessary specialists to work for the representation, non-disclosure agreements, etc.

- Guarantees of the legality of maintaining the accounting systems of the representation.

- Assistance in passing tax inspections and protecting your interests in all state agencies.

We also assist with the hiring process for employees, whether they are Ukrainian or foreign nationals with a work permit. This involves three stages:

- Issuing a work order;

- Preparing a labor contract with the employee (in two copies for each party);

- Notifying the Tax Service about the new employee.

To learn more about the differences in hiring foreign nationals and Ukrainian citizens, click here.

Working with us offers several benefits:

- Streamlined legal and accounting services, providing comprehensive support that saves time on coordination, ensures accurate answers, offers recommendations for decision-making, and holds accountability with one company.

- Payment for results, not just processes;

- Reliable protection against legal and tax risks and unforeseen expenses.

For information on the cost of legal and HR support for foreign representative offices in Ukraine, click here.

Didn’t find an answer to your questions?

Everything you need to know about foreign companies operating in Ukraine here.

Our clients