Targeted and non-targeted aid in Ukraine. tax consequences

Cost of services:

Reviews of our Clients

Under martial law, the activity of charitable organizations, NGOs, and volunteers has intensified enough to collect funds and property to provide charitable assistance to the Armed Forces of Ukraine and the affected population or those who were forced to change their place of residence as a result of the hostilities.

When organizing and coordinating such processes, one should not forget about the accounting and tax nuances of providing charitable assistance. In this article, we will elaborate on the issue of providing targeted and non-targeted charitable assistance.

Rules for charity foundations

A charitable organization carries out its activities within the limits of the goals and directions defined by the law and the charter of the organization. A charitable organization usually has a non-profit status. Therefore, it is very important to maintain this status for the entire period of activity of the organization. It is possible to lose the non-profit status in the following cases:

- The use of income (profits) does not correspond to their intended purpose or not for the implementation of goals (tasks, directions), which are defined in the constituent documents of the organization.

- Violation of requirements for non-profitability and distribution of income (profits) between members (participants) and related persons (except for payment of salaries);

- Non-compliance of the organization or the organization's documents with the requirements established by the Tax Code of Ukraine.

Targeted charitable assistance is the assistance given to the beneficiary (recipient) under certain conditions and activities. Other types of assistance are considered non-targeted.

You may also like: Acceptance of Humanitarian Aid on the Fund's Balance Sheet

The tax treatment of charitable foundations

Recently we were approached by a client who wanted to provide charitable assistance to internally displaced persons. Since the client is a non-resident with a registered charitable foundation in Ukraine, he was not aware of the tax nuances of rendering charitable assistance in Ukraine.

For example, a receipt for charitable assistance does not work in Ukraine, moreover to avoid tax risks we should separate target and non-target charitable assistance, and document its provision. We have analyzed the client's request, identified the charitable assistance as targeted, and prepared all the necessary documents for the transaction. Now the client will not have to worry about inspections by controlling bodies.

If a charitable organization provides targeted charitable assistance, you should make sure that this assistance is given for the needs defined by the Tax Code of Ukraine, and that the charitable assistance is not included in the taxable income of individuals (annual or monthly).

Providing targeted charitable assistance also has some peculiarities, which depend on the subject and purpose of the charitable assistance. Our advice is better to additionally analyze the tax risks before providing charitable assistance, and to be able to document the provision of charitable assistance.

In the case of non-target charitable assistance, as a general rule, the amount of non-target charitable assistance, which does not exceed UAH 3,640 per year, is not subject to personal income tax. However, the tax law allows providing non-target charitable assistance in some cases (environmental disasters, during a state of war or emergency, natural disasters, etc.).

In March 2022, amendments were made to the TCU, allowing for targeted and non-targeted charitable assistance for the needs of military personnel, their families, and some businesses.

In the work of a charitable organization, the tax aspect should be taken into account and the documents confirming the provision of charitable assistance should be kept.

If the requirements of the tax legislation are not taken into account, the charitable organization runs the risk of having personal income tax charged on the charitable assistance rendered, a tax audit, and penalties.

You may also like: How to Keep Track of Charity Expenses?

Documentary confirmation of the transfer of charitable assistance to the organization's records

When providing targeted or non-targeted charitable assistance, it is necessary to ensure the existence of documents confirming the legal relationship between the provider and the recipient. The most common case is the use of charitable assistance agreements.

We advise that an agreement on the provision of charitable assistance, in addition to the essential terms of the contract, should specify:

- The amount of money or property (in cash equivalent) to be transferred to the recipient;

- The purpose for which the funds will be spent (in case of targeted charitable assistance);

- The possibility of returning the funds or property in case of misuse;

- Prohibition or permission to transfer funds or property to other persons;

- The obligation of the recipient to provide documents confirming the use of funds or property.

In addition to the contract, you should also sign certificates of acceptance in which you confirm the transfer of property or funds. In case of targeted charitable assistance, ask the recipient for a request with justification and a list of property or the amount of money. You should keep all documents about the transfer of charitable assistance.

You may also like: Is It Possible to Get Charity in Cryptocurrency?

Violation of the law on charitable assistance treatment

In the case of a violation, based on the results of a tax audit, the State Tax Service has the right to:

- Deprive the organization of the non-profit status.

- Charge income tax, personal income tax, penalties and fines.

Considering the above, we recommend avoiding risks and carrying out the activity of a charitable organization within the limits determined by the statutory documents and legislation of Ukraine.

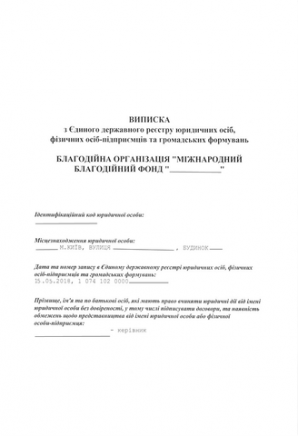

Our company performs registration of non-profit organizations, in particular charitable foundations, and gives recommendations on the further work of such organizations.

If necessary, we also offer support services to charitable organizations in Ukraine.