Real estate donation agreement: rules, procedure for concluding

Cost of services:

Reviews of our Clients

When entering into a donation agreement, where one party (the donor) transfers certain property or other rights to another party (the recipient) without any payment involved, it is important to consider several legal requirements. The process of donating real estate can give rise to various questions:

- Are taxes applicable when donating real property?

- Under what circumstances can a donation agreement be contested or deemed invalid by a court?

- Is it possible to give a gift first and then formalize the donation agreement later?

- In what situations is it more advisable to opt for a sales agreement instead of a donation agreement?

In our article, legal experts will guide you through all the essential aspects of properly documenting a donation agreement for real estate. We also offer all the additional services you may need for a successful real estate transaction:

- TIN and migration services for foreigners;

- optimization of taxation;

- optimization of taxes through the authorized capital of the LLC;

- withdrawal of funds abroad, etc.;

- obtaining a technical passport, BTI permit, carrying out an expert assessment of real estate;

- legalization of reconstruction, change of purpose;

- working with the bank for non-cash settlement;

- objects of cultural heritage;

- we solve the issue of land, profitable territory;

- redevelopment of buildings, legalization of self-build, construction amnesty, privatization, etc.

Requirements for concluding a donation agreement for real estate in Ukraine

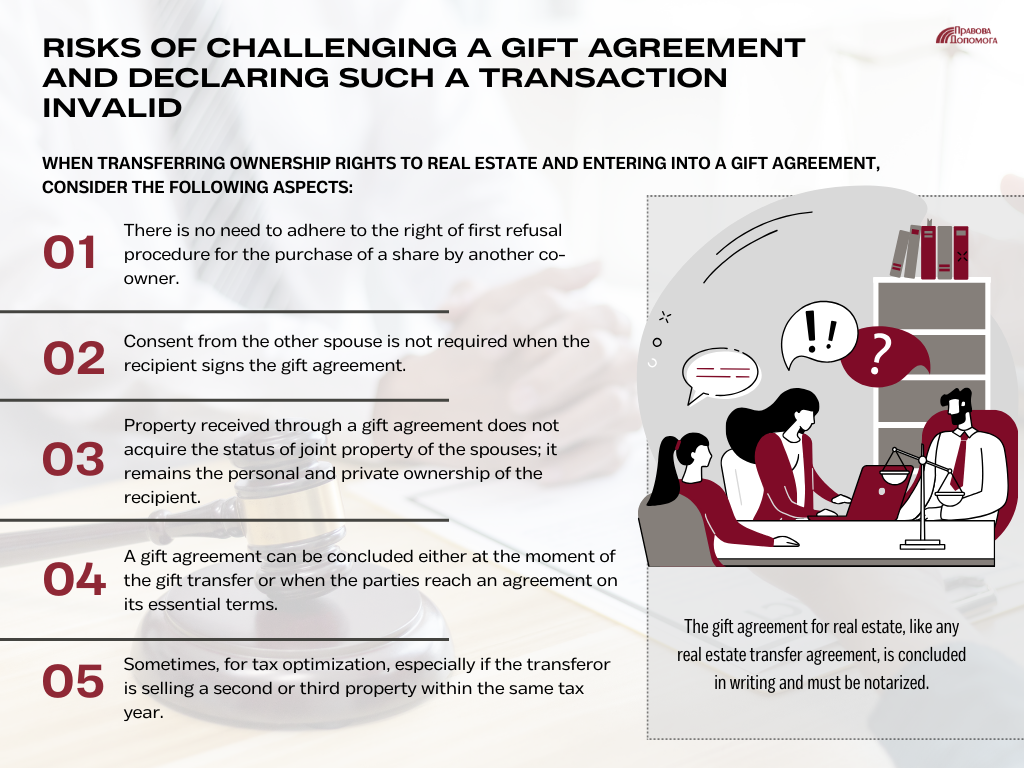

A donation agreement for real estate, just like any other agreement involving the transfer of real property, must be in written form and require notarization.

During the notarization of the agreement for the transfer of a real estate or an unfinished construction project, the property rights or special property rights associated with its acquisition are simultaneously registered with the government. Under a donation agreement, you can transfer various types of real property such as a house, land plot, building, individual units within a building, apartment, residential or commercial premises, and even unfinished construction projects.

When specifically entering into a donation agreement for an unfinished construction project, the ownership rights to the unfinished property must be registered. The list of documents required for transferring an unfinished construction project through a donation agreement includes permits for construction work, such as:

- Registered notification;

- Construction work permit;

- Construction passport;

- Document confirming the right to the land plot, and so on (the list is not exhaustive).

You may also like: How to Conclude a Real Estate Exchange Agreement in Ukraine: A Step-by-Step Guide

Do you need to pay taxes when donating real estate?

The taxation of real estate donations in Ukraine depends on the degree of relationship between the donor and the recipient.

If the donation is made between first or second-degree relatives, such as parents, spouses, children (including adopted children), siblings, grandparents, and grandchildren, no taxes are levied. In these cases, the market value of the property is not taken into consideration for tax purposes.

However, if the gift of real estate is received from individuals who are not immediate family members, a 5% personal income tax (PIT) and a 1.5% military fee are applicable. The taxable value of the property is determined based on either the assessed value or the market value.

In the case of donations to or from non-residents, the tax rate is 18% PIT plus a 1.5% military fee. It is important to note that taxes must be paid at the time of notarizing the agreement.

If you inherit property, including funds, assets, or property rights, within the taxable limits, you are required to declare it in your annual tax return, which must be submitted by May 1st of the current year.

You may also like: What Should Property Owners in Ukraine Do with Their Real Estate While Abroad During Times of War?

Risks of contesting a Donation Agreement and invalidating the transaction

When it comes to transferring ownership of real estate and entering into a donation agreement, it's crucial to consider the following aspects:

- No obligation to comply with the right of first refusal by other co-owners. During periods of martial law in Ukraine, the time limit for exercising the right of first refusal (originally set at 1 month) is extended for the duration of the martial law or state of emergency. This extension is often exploited by co-owners during martial law.

- No requirement to obtain the consent of the other spouse when the recipient signs the donation agreement. Property received through a donation agreement doesn't become a joint property with the spouse but remains the recipient's personal and private ownership.

- A donation agreement can be concluded either at the time of the gift transfer or when the parties agree on its essential terms. This means it's possible to retroactively notarize a donation agreement using the retroactive effect stated in Part 3 of Article 631. This allows for the legal formalization of previously established rights and obligations.

- In some cases, for tax optimization purposes, the donor may sell a second or third property within the tax reporting year.

However, there are certain risks involved in contesting a donation agreement and declaring the transaction as fraudulent.

If the donor lacks a clear intention to transfer the property to the recipient without any consideration, or if the recipient engages in any property-related actions, such as transferring funds to the donor, it can be grounds for invalidating the donation agreement.

It is important to note that a donation agreement cannot be used as a means to evade debt repayment or to circumvent a court order for debt collection. Such actions by the parties are considered dishonest and an abuse of rights.

A donation agreement may be declared invalid by a court if the property in question is subject to any restrictions on its disposal, provided that such encumbrances were not properly registered in the property registry.

When donating real estate to a minor child, there is no requirement for obtaining permission from the guardianship and custody authority.

To mitigate these risks, when conducting an audit of the real estate in question, we thoroughly analyze the donor as well. This is because if the donor is involved in any legal disputes or has outstanding debts, it increases the likelihood of the donation agreement being contested. Therefore, in some cases, it may be more advisable to consider a sales agreement instead.

At our firm, we approach each case with our client's comfort and best interests in mind, offering tailored solutions to meet their specific needs. We ensure that the entire process is organized and conducted in full compliance with the law.

If you need assistance with any type of real estate transaction, please do not hesitate to contact us!

The cost and range of services provided by our real estate lawyers here.