LLC Liquidation in Ukraine

Cost of services

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

What we offer

-

Examining the client's situation and offering the optimal service for liquidating an LLC in Ukraine in each specific case.

-

Exploring avenues to minimize potential risks for founders and company leadership not just during the enterprise's closure phase, but also post-process completion.

-

Addressing issues linked to the dissolution of the legal entity (establishing a liquidation commission, conducting asset inventory, compiling a liquidation balance, formalizing the cessation of employment relationships with company staff, and more).

-

Guiding the process of undergoing tax inspections upon LLC closure in Ukraine, right through to acquiring debt-free certificates and deregistration.

-

In the case of a business sale in Ukraine, we identify trustworthy and conscientious buyers.

Our advantages for you:

- You can quickly transfer a company without even being in Ukraine - our practice of more than 15 years allows you to do it without your participation, completely by proxy.

- A safe option to get rid of the business: all your actions are within the law. We openly discuss all risks, give choices, select the safest option for the client.

- We will organize the procedure with all the necessary additional actions: we will change the location of the company; we will solve the issue of changing the founders for NGOs; we will solve the problem of closing a company with two owners, if one of them has disappeared; we will involve an accountant in the case if necessary.

- We know how to liquidate your company even in those cases when no one takes on this matter. The number of successful cases is over 100 over the past 10 years.

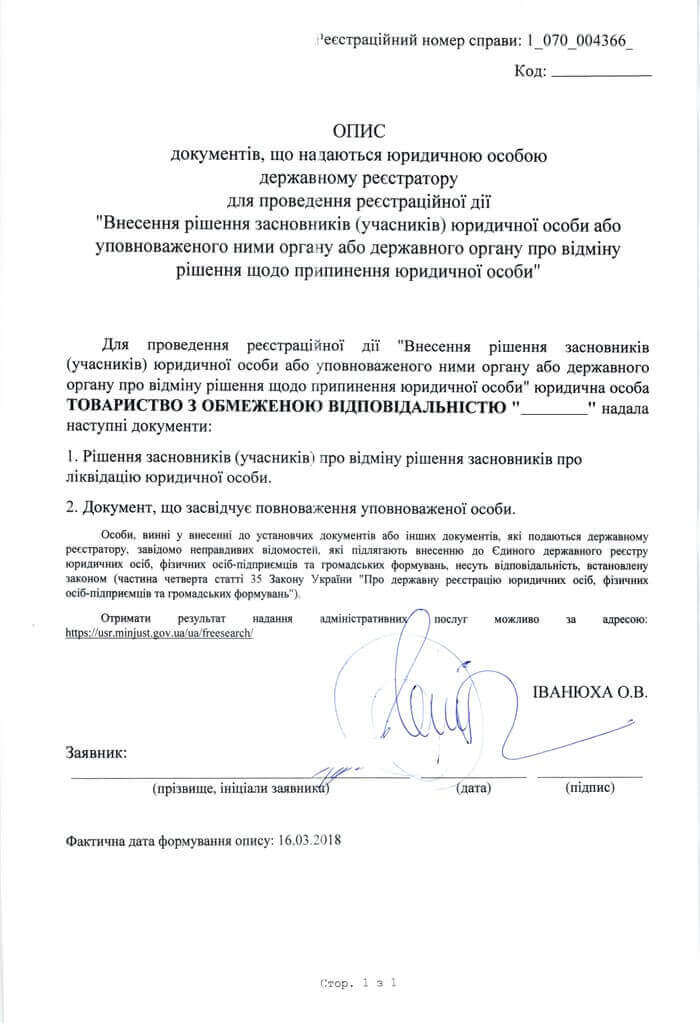

Documents

Timeline for Company Liquidation in Ukraine in 2022

For an expedited process (2-4 business days), "urgent company liquidation" can be conducted. The cost, nuances, and minimum timelines are assessed individually in each case.

In other scenarios of winding up a company (LLC or sole proprietorship) in Kyiv, completing the process in less than 2 months is not feasible. However, it's important to note that the "2-month" timeframe is stipulated by legislation, providing creditors the window to assert their claims.

In practice, the liquidation procedure in Kyiv can take several years. This is due to the fact that a few years ago, regional tax authorities were responsible for inspecting liquidating companies. These functions were later transferred to the Kyiv city tax authority, which received archives from all regions. A queue for inspection was formed.

Throughout 2020 and 2021, inspections were halted during lockdowns and wartime as well. Consequently, a backlog for inspections has already formed for several years ahead. Whether the company is currently operational or not doesn't substantially impact this queue, unless perhaps inspections for non-operational entities are slightly faster.

Post clearance of the tax inspection, which also encompasses verifying the payment of the single social contribution (instead of pension contributions), a follow-up inspection at the social insurance fund is necessary. Documents must be submitted to the archive, a certificate obtained, and subsequently, the process circles back to the state registrar to record that the legal entity has definitively ceased operations.

When it comes to liquidating a legal entity (LLC) in Ukraine through bankruptcy, forecasting timelines upfront is challenging.

"Alternative liquidation" can address all the above concerns – the sale of the company. Afterward, all these responsibilities shift to the buyer. The buyer is fully cognizant of the situation they are stepping into. It then becomes their responsibility to manage these matters after the purchase.

It is important that the business transfer procedure is supervised by professionals. This can protect against many unpleasant nuances:

- Firstly, you will be sure that the company has really stopped carrying out any economic activity, rather than living its life.

- Secondly, the professional organization of the process will protect you from the need to correct documents, to submit them several times and in general to submit something somewhere. You’ll just need to go to the notary once.

If you want to get rid of an unnecessary company within the shortest possible time and without negative consequences, don’t hesitate to contact our employees.

Service packages offers

- Search and provision of buyers (including a new head) LLC

- Organization of purchase and sale of the company from a notary

- Organization of complete changes in the unified state register

- Storage of primary documents of LLC (by separate agreement)

- Consultation on the liquidation procedure, the documents and information required to start the procedure

- Drawing up the protocol of the general meeting, where the decision to terminate the company is made

- Submission of documents to the state registrar to start the process of liquidation of the company

- Submission of documents for termination to the tax office and social insurance office

- Reconciliation in the tax office for the presence of debts or overpayments

- Organization of payment of fines and debts (if any)

- Control of the purpose of the inspection in the tax office

- Obtaining certificates of no debt and deregistration in the tax office and social insurance

- Organization of transfer of primary documents for storage in the state archive

- Complete termination of LLC at the state registrar

- Consultation on the liquidation procedure, the documents and information required to start the procedure

- Providing our liquidator who will lead the entire liquidation process

- Drawing up the Protocol of the general meeting, where the decision to terminate the company is made

- Submission of documents to the state registrar to start the process of termination of the company

- Closing bank accounts (Ukraine only)

- Submission of documents for termination to the tax office and social insurance office

- Reconciliation in the tax office for the presence of debts or overpayments

- Payment of fines and debts (in case of their prior compensation by the Client)

- The organization of storage of primary accounting documents of Open Company in our company

- Control of the purpose of the inspection in the tax office

- Passing the inspection in the tax office and social insurance office

- Obtaining certificates of absence of debt and deregistration in the tax office and social insurance office

- Transfer of primary documents for storage in the state archive

- Complete termination of LLC in the state registrar

Dissolving a Legal Entity in Ukraine — Costs

The cost of liquidating an LLC (company) in Kyiv and across Ukraine is determined on an individual basis for each case and hinges on specific factors:

-

The chosen method of company liquidation (decision by founders, bankruptcy procedure, or "alternative liquidation").

-

The timeframe for service provision.

Consequently, the answer to the query "What's the expense of dissolving/closing an LLC?" is contingent solely upon your circumstances and the resolution adopted.

The price of the "LLC Dissolution" service does not encompass notary fees and official charges (these differ based on the type of liquidation; for "alternative" company liquidation, the cost incorporates payments for director changes and alterations to founder composition).

For those seeking to initiate the liquidation of an LLC (business), our experts are accessible via phone or by utilizing the feedback button.

Documents for LLC Dissolution in Kyiv

Throughout the process of LLC dissolution, an extensive array of documents will be requisite, with some needing acquisition during the liquidation commission's course. Let's highlight two document sets necessitated for submission to governmental bodies.

Documents for Submission to the Tax Authority for LLC Liquidation:

-

Original Certificate 4-ОПП;

-

Copy of the document containing the decision to liquidate the LLC;

-

Copy of the document regarding the establishment of the liquidation commission;

-

Liquidation card from the statistical authorities;

-

Liquidation balance (annual report).

Documents for Submission to the State Registrar for LLC Liquidation:

-

Statement from the owner or authorized entity about the liquidation of the LLC (a court decision can also be submitted);

-

Liquidation commission report with the liquidation balance;

-

Auditor's certificate;

-

Tax authority certificate for deregistration;

-

Archive certificate confirming the acceptance of documents for safekeeping;

-

Original founding documents of the company;

-

Certificate of LLC registration.

Why us

Our clients

Our successful projects

Duratipn and cost of company liquidation in Kyiv

Cost of the service provision is evaluated individually for each particular case and depends on the following:

- location of registration (our lawyers will be able to liquidate your company in Kiev or Donetsk without any additional costs. Other regions will require reimbursement of travel expenses);

- option of liquidation (whether it is liquidation that results from decision of founders, banruptcy procedures, "alternative liquidation");

- term of service provision.

Required documents for liquidation of company process

- copy of extract from the USR or legal entity state registration certificate;

- charter of company.

We can organize "altenative liquidation" within short period of time.

Other options of liquidation will not enable you close you company sooner than in 2 months.

Types of Business Liquidation in Ukraine

The current legislation of Ukraine provides several options for liquidation. Choosing the right option for you will depend on many factors, for example: the legal form of business, type of economic activity, the amount and structure of accounts payable and receivable, the number of assets, the availability of the necessary financial and accounting statements of the company, etc.

For more information about the types of LLC liquidation, you can explore the following links:

Alternative LLC Liquidation: This involves the process of transferring an LLC to a new owner through the procedure of "Alternative LLC Liquidation." After the purchase, all subsequent responsibilities for the company are assumed by the buyer. The re-registration process usually takes a few working days. You can find timelines, costs, and the step-by-step procedure by following the link.

In cases where a company is burdened with debts or is involved in criminal investigations, the change of director to a new one does not release the former director from personal liability.

LLC Liquidation with Debts in Kyiv- Legal Advice on Liquidating a Company with Debts. Is such liquidation possible and how is the process of liquidating an LLC with outstanding debts carried out? Click the link to learn about the timelines and procedures for liquidating a company in Kyiv with debts.

LLC Liquidation via Participant Withdrawal: Our legal experts will illustrate the process of withdrawing individual participants from an LLC using practical examples. Click the link to gain insights into the procedure of company liquidation through participant withdrawal.

LLC Liquidation by Owner's Decision: в In this article, you'll discover the steps an owner should take if they decide to cease the operations of an LLC. We'll outline the procedure for LLC liquidation and delve into the particulars of winding down a company, including details like protocol creation and the establishment of a liquidation commission. Read more here.

LLC Liquidation through Bankruptcy: Exploring the distinctive aspects of the procedure for liquidating a company in Kyiv and Ukraine through bankruptcy. Click the link to understand the timelines and intricacies of LLC bankruptcy.

Legal Consultation for Company Liquidation in Kyiv

Company liquidation involves a complex process with numerous stages, each accompanied by various challenges. If you're looking to navigate these difficulties and gain a comprehensive understanding of the company liquidation process, don't hesitate to reach out to us for an introductory consultation!

During this consultation, our lawyer will analyze your specific situation and provide tailored solutions depending on your circumstances. We aim to provide detailed and clear answers, going beyond simply citing legal norms.

During the introductory consultation, our specialist will:

-

Explain the general procedure for LLC liquidation.

-

Present multiple solutions that suit the specifics of your case.

-

Clarify the concept of alternative liquidation and its potential benefits.

Our legal expert will also discuss potential risks and issues, as well as strategies to mitigate them.

If you have numerous or unconventional queries, we recommend considering a "Roadmap" service. This step-by-step action plan, devised by our lawyers, is designed to help you achieve your goal. The cost of the "Roadmap" is also included in the service fee if you decide to proceed with our LLC liquidation assistance.

How to close an LLC with debts through reorganization?

Initiate a reorganization by transferring its assets, rights, and responsibilities to the legal successor.

Downsides: It's important to grasp that this doesn't automatically resolve the issues, as the legal entity itself essentially disappears. However, the notion of a legal successor comes into play – someone who would agree to take control and shoulder the debts.

How to liquidate an LLC by filing for bankruptcy?

As you know, bankruptcy begins when a company cannot repay debts to its creditors. However, contrary to widespread perception that the creditors are counterparties, employees and banking institutions, the tax authorities may also act as creditors.

This means that in case of tax debt, which the company is unable to settle, you can also initiate the bankruptcy proceedings. Sometimes this may be the most appropriate way to address the tax debt issue.

Closing an LLC with a zero balance: Specifics and Advantages of the Procedure

There's a viewpoint that closing LLCs with a zero balance happens more swiftly. To a certain extent, this holds true. Yet, due to the current review backlog, including those for zero-balance LLCs, the timeline isn't confined to just a few months. In reality, it takes about a year. The advantage lies in the relatively prompt nature of completing the audit process, which, nevertheless, still demands waiting.

Challenges When Dissolving an LLC in Ukraine

- Unsubmitted Reports. Often, the issue arises that certain reports have not been filed. Even if they were filed, glitches in the tax system might prevent their proper reflection. This necessitates presenting copies with acceptance stamps, as well as receipts for electronic report submission.

- Unpaid Taxes (Underpayment, Overpayment). If a company has operated for an extended period, had numerous employees, and significant turnovers, no accountant is immune to errors, including payments to incorrect requisites.

- Lost Primary Documentation (Transfer and Acceptance Acts, Contracts, Invoices, etc.). Relocation, changes in accountants or management, or simply neglecting to request documents from a counterparty – all these scenarios can occur.

- Differing Positions Among Government Officials. There are situations where the same legal provisions are interpreted differently. It can be quite disheartening when government officials have their own unique interpretations.

Our company takes a proactive approach in navigating the process of business dissolution in Ukraine. This approach helps preempt such problems and allows you to minimize your involvement in the overall process.

What to do in case of tax payment errors detected during the liquidation procedure?

Sometimes during the company’s operation, things go unplanned or the plan is false: supporting documents are lost, accountants are confused, and make mistakes, etc. All this may result in certain problems during the liquidation of the company.

Case: We were contacted by a Client whose accountant did not timely notice that the company’s total income exceeded one million and they had to apply for registration as a VAT payer by the 10th day of the following month.

Thus, they missed deadlines, didn’t pay the tax, and “shelved” the company, hoping that the tax authorities wouldn’t notice that. And no one actually noticed that until the liquidation inspection, during which a number of other violations were found.

Since the Client contacted us during the audit, our auditors and lawyers had to make every effort to resolve the situation painlessly for the company’s management.

In such cases, you can also use the “alternative liquidation” model, since there are services that sign the problem companies over themselves and perform the liquidation procedure on their own.

Answers to frequently asked questions

Why can the liquidation process take years?

According to the legislation, the tax authority must appoint an audit not later than one month from the moment of receipt of the documents on the liquidation of the enterprise, but due to its workload the tax authority may postpone the consideration of documents for an indefinite period.

Is it possible to withdraw from the founding members of a company that is in a state of liquidation?

No, you can't. The only way is to cancel the liquidation procedure and then start it again.

Procedure and term of closing (terminating) an LLC: Ukraine, Kyiv and regions

We can offer several options for dissolving a company (LLC or PE) in Ukraine. The stages of the LLC liquidation procedure, as well as the price of the LLC termination and the relevant services, will depend on the line of approach to the final goal, which we will coordinate with the Client, and sale, change of owners in another way, etc.

An “alternative liquidation” is the fastest way to change the founding members and withdraw from the management of the company. However, this procedure does not always exclude the risk of liability of the founders or management (even if they are no longer employees of the company).

Of course, one of the most pressing questions that our Client Managers hear is whether it is expensive to terminate a PE or LLC in Ukraine and what is the price of the accelerated procedure. To find out the price and duration of the procedure, you must first of all, determine the actions that we will take to resolve the issue as efficiently as possible.

The procedure of liquidation of LLC, PE in Kyiv

Our lawyers offer You the following services:

-

Liquidation of an LLC in Kyiv on a turnkey basis;

-

Liquidation of an LLC with debts;

-

Alternative liquidation of an LLC;

-

Urgent liquidation of the company;

-

Liquidation of the company through bankruptcy.

Provision of this service can begin with a consultation on the options for the LLC liquidation, and later - can be followed by liquidation (if the Client has already been consulted about the key points of this procedure). Before starting our cooperation, we sign an agreement with the Client.

After paying for our services our lawyers start developing documents to successfully terminate the company and implement necessary actions. At this stage our lawyers may need to cooperate with the Client’s accountant (if required and stipulated in the agreement).

Upon termination of the services, the Client’s company (LLC or PE) officially loses its status of a legal entity (in case of the “alternative liquidation”, the corporate rights and the company management are transferred to persons who are not related to the Client).

To sketch out the LLC liquidation procedure, say, by the decision of the owner, you will have to go through the following stages:

-

Making a decision to liquidate an LLC. Such a decision shall be taken at the General Meeting of LLC members and recorded in the Minutes.

-

Filing documents to the state registrar. A full package of documents, including the adopted decision, shall be submitted to the state registrar within 3 business days following the date of the decision on the LLC liquidation.

-

The work of the liquidation commission. This is a whole complex of actions, which includes, for example, closing the accounts of the legal person, an inventory of its assets, the dismissal of employees, etc. As a result, an Act of the Liquidation Commission is drawn up, which specifies a list of the actions carried out and the documents obtained as a result.

-

Filing the final package of documents on termination of the legal entity to the state registrar.

Of course, the procedure of alternative liquidation or liquidation of the company through the court will be absolutely different and will consist of other stages.

If you don’t know how to correctly dissolve the company in Kyiv or regions, don’t hesitate to contact us.

We have been working in this area for more than 10 years and have passed each of the possible procedures dozens of times.

Moreover, we have strict standards of our services and follow them rigorously.

-

Our lawyers have in-depth legal expertise. This means that our competence is not limited to one area of the law. We carefully study all new developments in the law, constantly develop new services, and gain experience in a wide variety of legal fields to be able to solve any problem more effectively.

-

We are open-minded. Our case studies, in the form of articles and publications, are regularly published on our website, and are available to anyone who wants to get more information or to try to figure things out for themselves. You won’t find a single cheated review - behind each review there is a real person and invaluable experience.

If you want to know how to liquidate an LLC, how much it costs to terminate a company in Ukraine and whether it can be done in the shortest possible time - our lawyers have answers to all these questions. Don’t hesitate to call us!