Re-export of goods in Ukraine: rules, conditions, features in 2023

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

If you work in Ukraine, but your contractors are foreign companies, you may face the following situations and questions:

- Our company has imported goods from a non-resident, but their quality does not meet the terms of the contract. How can we return or exchange the goods?

- We want to terminate the contract with a non-resident and return the goods previously delivered. How shall this be done from the legal and accounting point of view?

- Importing goods for the purpose of further resale to another non-resident? Are there any tax benefits?

- We provide goods processing services to a non-resident and then send it to the same non-resident. What kind of transaction is this from the point of view of legislation and how do we register the transfer of goods?

All the above-mentioned operations refer to the customs regime called re-export.

Our company provides legal and accounting support to solve any problem, from the conclusion of the contract with the client until the customs border crossing. Today, we will share our experience in solving problems related to re-exports.

You may also like: VAT Payment and Refund Methods in the EU in 2022

What is re-export, and which operations fall under this concept?

Re-export is a customs regime, which is accompanied by the process of exporting goods that were previously imported into the customs territory.

There are several reasons for the necessity of re-export registration. They include:

- return of goods in connection with the termination of the contract with the client;

- receipt of goods in improper form from a non-resident;

- export of goods previously placed in the processing regime;

- export of goods previously placed in the customs warehouse regime (goods are exported without changing their exterior and technical characteristics);

- goods imported by mistake;

- other reasons that do not contradict the legislation.

In a similar vein to the import and export operations, re-export requires clearance at the customs office.

Please note! During customs clearance, you must have the documents confirming the initial import of goods into the customs territory (contract, Customs Cargo Declaration, and other documents).

In order to register a re-export operation, the entity engaged in foreign economic activities must provide the following documents to the customs office (customs broker):

- documents for the goods;

- information for the identification of the goods;

- permission for export of goods under the given customs regime (for certain categories of goods).

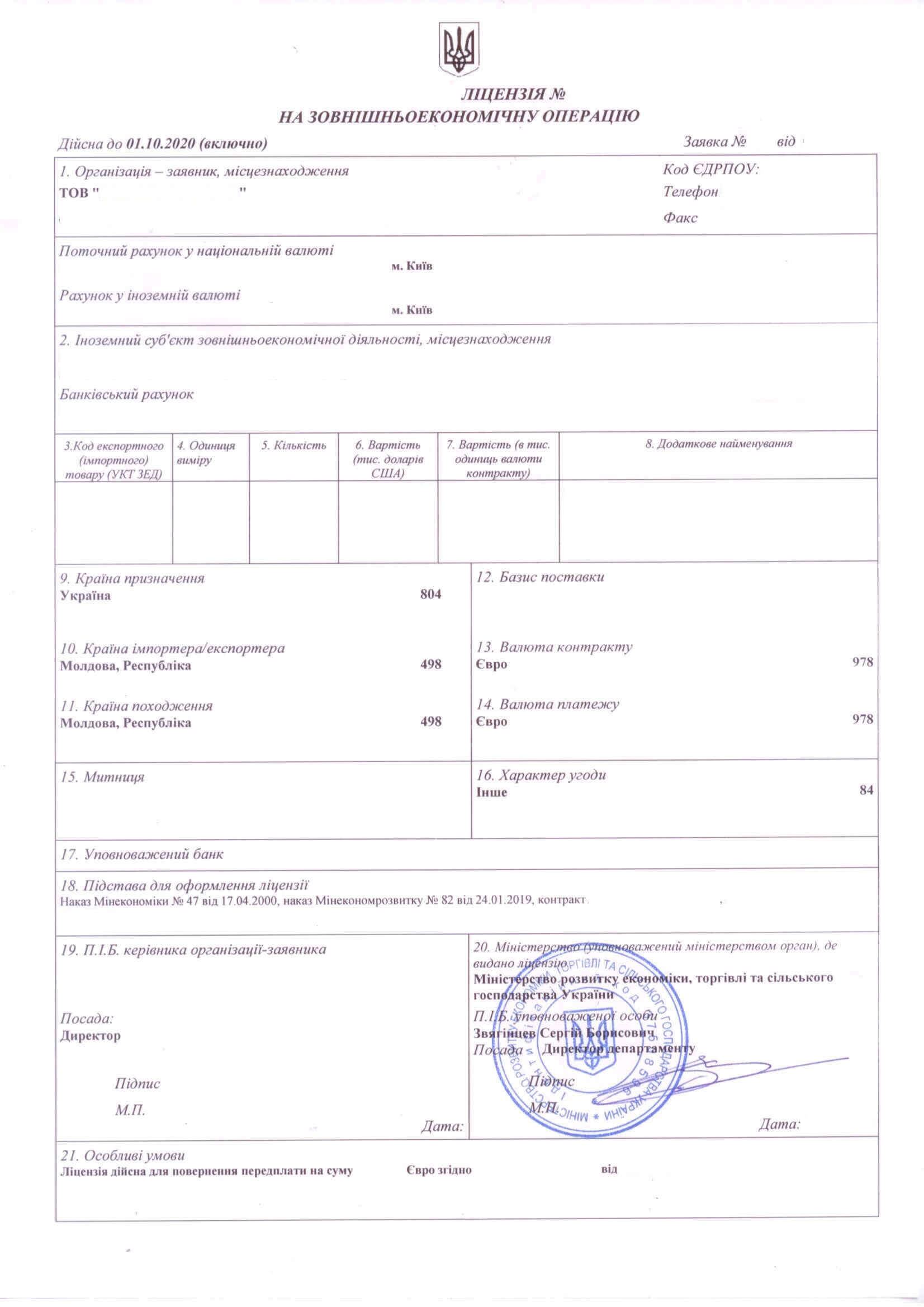

The permit for export of goods under the re-export procedure is issued by the Ministry of Economy of Ukraine within 15 business days after the application.

The criteria for issuing such permit are as follows:

- re-exported goods shall be in the condition they were imported;

- the goods have not been used on the territory of Ukraine;

- the goods shall be exported under the re-export procedure no later than 6 months from the date of their import.

Re-export formalities can be handled at any of the customs offices (it is not necessary to declare at the customs office where the import was processed). After re-exporting, you receive a declaration EK11 AA “Re-export”.

You may also like: FEA Settlements under Martial Law

Accounting of re-export operations

The customs declaration and the package of primary documents are the basis for reflecting re-exports in accounting. Since re-export is an operation that involves the return of goods, in accounting it is reflected according to the return principle:

- the company’s income decreases;

- the warehouse balance is reduced by the goods that have been withdrawn from the warehouse.

Please note! When re-exporting, the expenses included in the cost of previously imported goods (logistics, brokerage, insurance and other expenses) are deducted from the cost of goods.

The costs are referred to other expenses of the period (account - 949).

If your company incurred additional expenses while re-exporting – they are included in other expenses of the period, similarly to the allocated expenses at import.

Taxation of re-export operations

Regarding the taxation of re-exports, there are some advantages, namely:

- Companies do not pay customs duties when exporting goods under this regime;

- No measures of non-tariff regulation are applied.

Profit tax on re-export operations is calculated on general grounds according to accounting principles. Tax differences in the reflection of re-exports are not provided for at the legislative level.

You may also like: Accounting and Tax Audit in Kyiv

Re-export and VAT

Unlike income tax, VAT on re-export has its own peculiarities. VAT on re-export operations depends on the regime under which the goods were initially imported into the customs territory, namely:

- if the goods were imported under the import or processing regime, in case of re-export of such goods 0% VAT rate is applied to the operation and VAT compensation is not accrued;

- if the goods were imported under other customs regimes (not import or processing) - the rate without VAT is applied. The operation is exempt from VAT with subsequent accrual of compensated VAT liabilities.

Currency control over re-export operations

General legislative norms of foreign economic activity and the deadline for the return of currency earnings are applied to re-export operations.

As of September 1, 2022, the period of return of currency proceeds is 180 calendar days. The start date of currency control is the date of execution of the Customs Cargo Declaration on re-export.

The operation is removed from currency control on the day of crediting of funds to the bank account of the resident by the non-resident.

Registration and support of re-export operations is only part of the services we offer our clients in support of import and export operations in Ukraine in addition to accounting and tax consulting.

If you are running or planning a business in Ukraine and want to focus on profit and development rather than on technical issues, don’t hesitate to contact us. We are a reliable partner that will solve any legal problems in Ukraine and abroad.

Everything about the accounting of foreign trade operations in Ukraine.

Our clients