Creation and management of business with partners in Ukraine

Cost of services:

Reviews of our Clients

Often a business is created by several partners, or at a certain stage of business development there is a need to attract new partners or investors, including foreign ones.

How to legally secure the partnership and build clear and understandable rules of the game, and how to withdraw from the business adequately, without terminating all agreements and relations with partners? We will tell in detail about all this and much more in this article.

This is one of the many issues that we, as a team of lawyers, resolve in the process of registering a business for foreign clients. We also:

- Will help you determine in what form to open a business in Ukraine;

- Will not abandon you at the start - we will not only register a company for you, but also offer further legal and accounting services;

- Will save you time and money. We are a ready-made team of project managers, lawyers and accountants who will take on the organization of personnel and accounting issues, password management, and also provide answers to any legal questions.

Oral agreements and the consequences of doing business together in Ukraine

If you intend to start a business with colleagues, friends or in general with unfamiliar investors who grant funds for the development of the project in Ukraine, please remember the golden rule – all these legal relations have legal implications. Therefore, they should be properly structured, legally enshrined and formed in such a way that you feel comfortable and safe to work with business partners.

Often partners neglect this rule, they consider a verbal “gentlemen’s agreement” between them unshakable under any circumstances. However, in practice, sooner or later the partners have disagreements, different visions of further development of the business and investment in it.

For example, two programmers team up and form a partnership to implement projects together. Over time, the projects develop, and the partners hire additional developers, testers, and other employees. However, because of disagreements, the partners cannot further develop the business together.

Since no agreements, corporate ties between partners were created, there was a problem with the distribution of business, projects, and the team. In this case, they managed to sit down at the negotiating table, correctly distribute the assets, the team, the projects, and stipulate everything in the agreement. But this is not always the way the situation develops.

Please note! Any disagreements that may arise can be avoided if everything is recorded on paper.

That is, rule No.1 of successful partnerships is no verbal “gentlemen’s agreements”. All partnership legal relations must be structured using contractual and corporate mechanisms.

You may also like: Business Planning for Business in Ukraine.

Partnership agreements in Ukraine

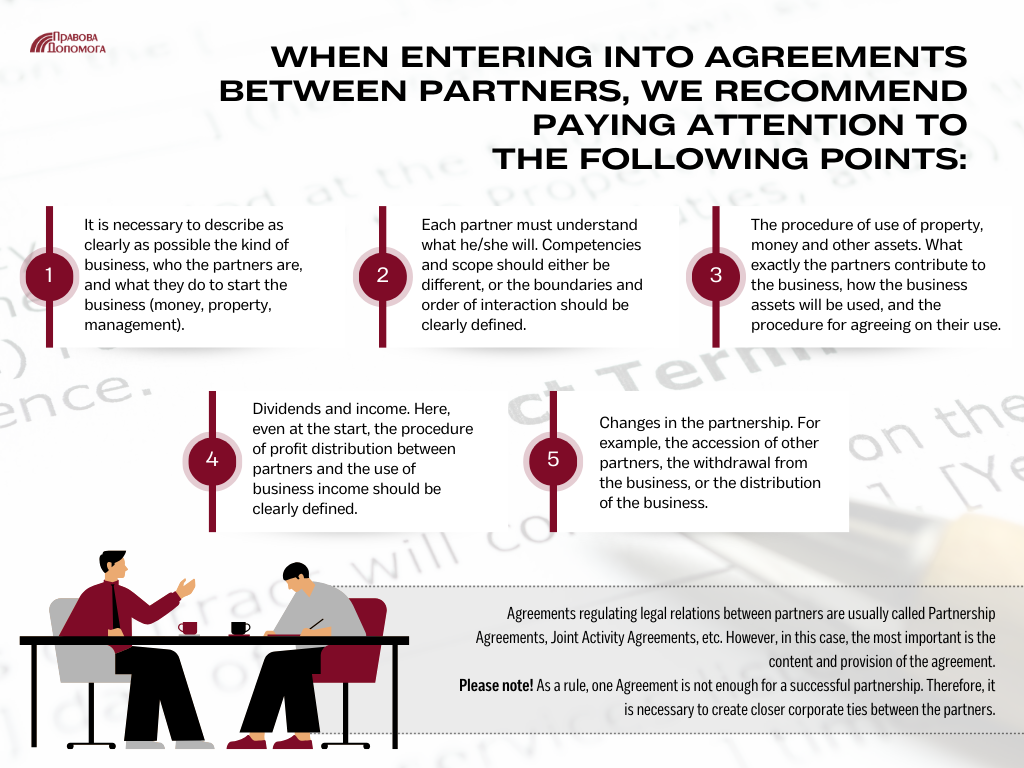

Agreements regulating legal relations between partners are usually called Partnership Agreements, Joint Activity Agreements, etc. However, in this case, the most important is the content and provision of the agreement.

When entering into such agreements between partners, we recommend paying attention to the following points:

The content of the legal relationship and the specification of the business. It is necessary to describe as clearly as possible the kind of business, who the partners are, and what they do to start the business (money, property, management).

The rights and obligations of each of the partners, the competence, the order of making and execution of decisions. Each partner must understand what he/she will do in the business. At the same time competencies and scope should either be different, or the boundaries and order of interaction should be clearly defined. For example, for the IT company, one partner may carry out organizational functions, search for clients and project management, while the other partner directly organizes the fulfillment of the order. However, there are certain issues that the partners may solve together.

The procedure of use of property, money and other assets. That is, what exactly the partners contribute to the business (their contribution), how the business assets will be used, and the procedure for agreeing on their use.

Dividends and income. One of the most important questions. Here, even at the start, the procedure of profit distribution between partners and the use of business income should be clearly defined.

Changes in the partnership. For example, the accession of other partners, the withdrawal from the business, or the distribution of the business. Provisions which clearly give the partners an understanding of the prospects for cooperation and guarantees for each of the partners are very important.

Please note! As a rule, one Agreement is not enough for a successful partnership. Therefore, it is necessary to create closer corporate ties between the partners.

You may also like: Who Better to Specify as the Founder of the Company: a Natural or a Legal Entity?

Business structuring

The best option for doing business is to create a full-fledged corporate structure that will be used for doing business. In Ukraine there are many available organizational and legal forms for business incorporation. Undoubtedly, the leader and the most popular is a Limited Liability Company. Such popularity is explained by the relatively simple procedure of establishment and management of LLC, introduction of changes, etc.

However, if you have decided to register an LLC, we recommend you the following:

- Avoid standard “law clichés” charters and develop one that truly reflects the agreements of the parties;

- Define procedures for major decisions, voting procedures and quorum. The mechanism of a corporate contract can be used;

- Define restrictions for a director or directorate to enter into contracts to a certain amount. In this way you can control the most important transactions in the company;

- Distribute shares in the company so that the distribution is consistent with the rights and responsibilities of the partners and the management capacity of the company;

- Clearly define the procedure for entry and withdrawal from/to the LLC.

Additionally, to shape the corporate structure, we recommend you the following:

- Register a trademark for your company. In this case, the registration should be in the name of a legal entity, not a partner, so that none of the partners could unilaterally dictate the terms. Also, if the business will receive patents for inventions or utility models, it is better to keep them in the ownership of the company;

- Conclude a corporate agreement between the partners, if necessary;

- Accumulate property and property rights and other assets acquired in the course of doing business in the business, not in the “pockets” of the partners. Because it will be difficult to agree in the event of a dispute. To do this, create a quality accounting, control of inventory;

- Distinguish between personal interests and the interests of the business. If one of the partners has a desire to employ relatives or acquaintances, such persons should perform their employment functions in the same way as other employees.

Please see more detailed information about the types and possibilities of business structuring here.

Working with our Clients we always analyze the vision and business model of the business and suggest the structure of the company that will meet the interests of all partners.

Disputes and their settlement between business partners

Inconsistencies and contradictions between partners may escalate into conflicts, which, as a consequence, can lead to the division of the business, the withdrawal of the partner from the business, or the complete termination of the business. Of course, no one thinks about such negative scenarios at the start, but they should.

Several years ago, we were contacted by a client who was planning to start a coffee shop with his girlfriend. They developed a business plan, agreed on costs, found staff and asked us to register a sole proprietorship. We advised the client to conclude a partnership agreement at the start of the business to avoid the risks if the partners wanted to separate. Two years later, there was a conflict between the partners and they had to divide the property, income, etc.

In this case, we used the provisions of the partnership agreement, which clearly stipulates the procedure of distribution of property and the balance of income in the event of termination of partnership or withdrawal of one of the partners. As a result, one partner retained the cafe and a portion of the property, while the other partner received a portion of the property and last month’s retained earnings, as well as a compensation payment.

To avoid disputes between partners, we recommend you the following:

- The Partnership Agreement, the corporate agreement and other documents shall clearly define the dispute resolution procedure.

- Involve a mediator in conflict resolution, but you will have to pay extra money for this.

- Create a convenient and reliable business structure with clear rules of the game.

You may also like: What Do You Need to Know About Electronic Contracts in Ukraine?

Five tips for building a partnership

- No verbal agreements on business partnerships. Record any agreements.

- Conclude an appropriate partnership agreement or similar, which clearly defines the basic provisions and rules of the business and interaction between partners.

- Gradually build up and create a business structure, register a legal entity, a trademark, etc.

- Conclude a corporate agreement on the management of the LLC, if such a need arises.

- Settle all disputes through negotiations and pre-trial settlement.

Our company will provide you with qualified assistance even at the stage of partnership planning, which will help you avoid most potential problems.

Everything about doing business in Ukraine here.

Everything about business investment opportunities in Ukraine here.