Exporting Funds Abroad

Cost of services

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

What we offer

-

Provide consultation on possible methods and procedures for exporting money from Ukraine or transferring funds abroad.

-

Select a proven method that is the most effective and reliable for your case, considering the availability of required documents and the final need for using the funds abroad.

-

Analyze potential risks associated with exporting cash both in Ukraine and in the foreign country.

-

Assist in preparing the necessary documents for the legal export of funds.

-

Explain what needs to be declared when crossing the border.

-

Complete customs declarations for exporting funds from Ukraine and legally importing them into another country.

What documents are required to transfer money abroad?

To declare money at the border, you must have the following documents:

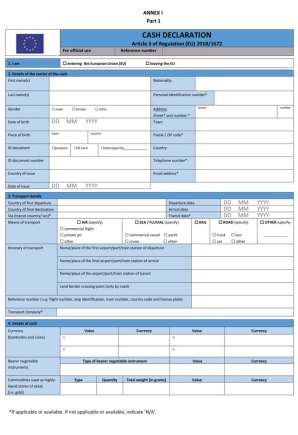

- Customs declaration: If you are carrying an amount of €10,000 or more (or its equivalent in another currency), this sum must be declared at customs. You need to complete a customs declaration that specifies the exact amount of money you are exporting.

- Bank withdrawal receipts.

- Currency exchange receipts (if available).

- Proof of the origin of funds. This could be a property sale agreement, proof of earnings from private entrepreneurship, etc.

The list of required documents may vary depending on the method of transferring the funds abroad and the specific requirements of the destination country. The final package of documents will be determined after an analysis of your documents and a consultation with our lawyer.

Service packages offers

-

Analysis of the client's situation and consultation on the process of transferring funds abroad

-

Development of alternative methods and procedures for transferring funds from Ukraine, tailored to the client’s specific case. Risk analysis (including tax implications) in compliance with Ukrainian and foreign laws

-

Assistance with gathering documents that confirm the legal source of funds

-

Preparation of necessary customs declarations for the transfer of funds abroad. If needed, submission of an official inquiry to the State Border Guard Service to clarify the required documentation for transferring specific amounts

-

Calculation of potential tax liabilities related to the transfer of funds

This package is divided into two stages, with each stage billed separately.

Stage 1:

-

Case analysis and consultation regarding the client’s situation

-

Identification of steps for legal support, scope of lawyer’s obligations, and cost estimation

Stage 2: (final cost determined based on Stage 1)

-

Verification of documents confirming the legal source of funds

-

Review of documents to ensure compliance with banking requirements and the legislation of the destination country

-

Drafting of documents to verify the source of funds, including loan agreements, gift agreements, service payment records, etc., including bilingual documents where necessary

-

Legalization of documents for foreign jurisdictions, including obtaining apostilles, translations, and notarization

-

Verification of the accuracy and validity of banking and notarial documents

-

Calculation of tax and other obligations, including addressing issues related to double taxation

-

Risk assessment and mitigation

-

Case analysis and consultation on the client’s situation

-

Determination of the client’s residency status

-

Risk analysis related to double taxation

-

Tax optimization strategies across various jurisdictions

-

Review of documents to ensure the legal compliance of funds

-

Identification of steps for legal support in transferring funds and ensuring their legalization abroad, with a clear outline of the lawyer’s responsibilities and a cost estimate.

What is the cost of legal services for transferring funds abroad?

The cost of legal consultation for transferring currency abroad is determined by several key factors:

- Steps required and urgency: If you need to resolve your issue urgently, the cost may be higher due to the need for expedited processing of your case.

- Availability of necessary documents: If you already possess most of the necessary documents, the service cost may be significantly lower. Conversely, if there is a need to assist in obtaining additional documents, this can impact the price.

- Selected method of transferring funds: Different methods of transferring funds may require different levels of legal support, which also reflects in the service cost. For example, if the funds are to be moved through several countries, it will be necessary to fill out declarations for both entry and export at each border, comply with the regulations set by different jurisdictions, etc., which could lead to a higher price.

During the initial consultation, our lawyers will analyze your situation in detail and provide complete information, considering all these factors, to ensure maximum transparency in the formation of legal service pricing. Additionally, in the Service Packages section, you can choose a service option that meets your needs and immediately understand the associated costs.

Why us

Our clients

Our successful projects

What are the restrictions on transferring funds abroad?

Under the current martial law, the National Bank of Ukraine (NBU) has imposed restrictions on individuals making bank transfers to foreign accounts. However, there are exceptions where transferring funds abroad is permitted, provided the necessary supporting documents are available. These exceptions include:

- Purchasing specific military-related goods (e.g., drones, bulletproof vests);

- Payment for educational services;

- Payment for medical services and transportation of the ill;

- Expenses related to the repatriation of a deceased person's body from abroad;

- Alimony payments;

- Fulfillment of obligations under external loans and credits.

For these transfers to be executed, the bank requires confirming documents, as the responsibility for conducting such transactions rests with the financial institutions.

Restrictions on cash withdrawals abroad

In addition to transfer restrictions, there are also limits on withdrawing cash from Ukrainian bank card accounts abroad. For example, as of August 2024:

- At Oschadbank, you can withdraw up to 12,500 UAH per week from your card if it is in hryvnia.

- Monobank has a similar limit for withdrawals from accounts in UAH.

Customs declaration of monetary funds and currency values

Transporting funds across borders requires adherence to strict customs regulations and an understanding of often complex nuances. Key aspects frequently of interest to our clients are outlined below.

What amount can be transported across the border without filling out a declaration? Transporting cash exceeding or equal to €10,000 requires mandatory declaration. If the amount is less, there is no need to declare.

How much does it cost to declare currency at the border? The procedure for declaring funds when crossing the border is free. No duties are charged for filing a declaration.

How to declare money at the border? Initially, you must accurately complete a special form, stating:

- Your personal information;

- The exact amount of cash at the date of crossing the border;

- The source of the funds;

- Other details.

Additional receipts and bank statements, currency exchange receipts, and other confirming documents, such as a sales contract, may also be required. By using our services, you need not worry about the correctness of the data entry, as we ensure all formalities are correctly filled out. Additionally, we will check all documents before your departure to prevent any issues so you can cross the border without any undue concern.

How to legalize currencies abroad?

Legalizing currencies abroad is crucial for their lawful use. To legally export currency and avoid issues with customs and banking institutions, follow these steps:

1. Declaring currency at customs when entering a foreign country. When transporting currency abroad, you must declare them during customs inspection upon entering a foreign country. Generally, this applies to amounts exceeding €10,000 or its equivalent in another currency, but the specific limit can vary depending on the destination. For example, in Saudi Arabia, you need to declare any amount over 60,000 Saudi riyals, which is about €14,000.

Declaring currency at the border serves as an official record of bringing cash into the country, which is essential to prove its legal entry. This is particularly important if you plan to deposit the funds into a bank account.

2. Documents proving the origin of funds. To ensure the legal use of your funds abroad, it's crucial to have documents that verify their lawful origin. These could include property sales contracts, dividend payment records, or evidence of business income. Having these documents on hand can prevent any suspicion about the source of the funds and allow for their legitimate use.

3. Opening a bank account abroad. If you plan to open a bank account abroad, you'll typically need identification documents and proof of the legal origin of your money. Once your account is set up, you can officially deposit the cash and carry out financial transactions.

By taking these steps, you’ll safeguard your funds and ensure their legal use abroad. Our team is here to support you through the entire process, providing expert advice and reliable assistance. We understand not only what documents are required at the border but also the specific demands of foreign banks. With our guidance, you can avoid delays and unexpected issues, both in Ukraine and internationally.

What documents should be provided to the bank to verify the source of funds?

To verify the source of your funds for the bank, you will need to provide specific supporting documents. These may include:

- Income statement from your employer: An official document from your employer confirming your earnings, such as salary, bonuses, or other compensations over a certain period.

- Tax return: A copy of the tax return you have filed with the tax authorities, which details your income for the reporting period.

- Bank statements: Statements from your bank accounts showing the inflow of funds, including salaries, interest on deposits, or other forms of income.

- Sales contracts: Contracts that verify the sale of assets such as real estate, vehicles, or other personal property. These should be accompanied by documents that confirm the receipt of funds from the sale.

- Inheritance documents: Notarized documentation, such as a certificate of inheritance, that confirms you have received an inheritance.

- Gift agreements: A legally binding document that confirms the receipt of funds or assets as a gift.

- Loan or credit agreements: A contract detailing a loan or credit arrangement, along with a bank statement showing the funds being transferred into your account.

- Business income records: Financial reports or other documentation that prove income from business operations. This may include contracts with clients, invoices, or dividend records.

- Other relevant documents: Any other documents that could verify the lawful origin of your funds.

The list of required documents may vary depending on the bank’s specific requirements. It is advisable to consult with a bank manager or one of our experts to confirm the exact documentation needed for your situation. Our company has an extensive network of international partners who can provide up-to-date information promptly and help minimize your involvement in the communication process with the bank, ensuring that all matters are resolved efficiently.

What happens if you don’t verify the source of funds with the bank?

If you fail to verify the origin of your funds, the following consequences may arise:

1. Refusal to open a foreign account: The foreign bank may deny your application to open a bank account if you cannot provide documents that prove the legitimacy of your funds. This can be especially problematic for those planning to relocate abroad and require access to their finances.

2. Refusal to conduct financial transactions: The bank or financial institution may refuse to process transactions involving these funds. This could include blocking transfers, withdrawing funds, or other financial operations, limiting your ability to manage your money both in Ukraine and abroad.

3. Account blocking: In the absence of proof of the source of funds, the bank may temporarily or permanently block your bank account. This means you won’t be able to access your funds until you provide the required documents and explanations confirming the legal origin of your money.

To avoid these issues, we recommend preparing all necessary documents in advance and seeking professional assistance. Our company can help ensure you meet the bank’s requirements and prevent any potential complications.

What risks are involved when transporting valuables abroad?

Transporting valuables and cash across borders involves several risks that could affect your financial and legal interests. To avoid unpleasant situations, it’s important to understand the potential threats when crossing the borders of different countries.

1. Violation of Ukrainian customs regulations: Failing to comply with currency declaration rules at the border can lead to fines and/or confiscation of your funds.

2. Violation of another country’s customs laws: Each country has its own rules for transporting cash across borders. In some cases, failure to comply can even result in criminal liability.

3. Tax risks: Depending on how you transport your funds, you may face significant taxes. Minimizing these taxes depends on the expertise of legal professionals.

4. Use of funds abroad: In many European countries, there is little tolerance for large amounts of cash. Most significant financial transactions are conducted through banks, and depositing large sums into a foreign account depends on choosing the correct method for transporting the funds abroad.

Our legal firm will analyze all potential risks in advance and provide you with thorough recommendations, ensuring you can safely and legally transport valuables abroad while avoiding any problems.

Answers to frequently asked questions

Is there a limit on the maximum amount of money that can be declared at the border?

The law does not impose a maximum limit on the amount of money that can be declared at customs.

Can a child carry money across the border?

Yes, any individual, regardless of age, can carry cash across the border. However, for children under 16, the declaration must be completed and submitted by their legal guardian.

Why declare money at the border?

Declaring your cash ensures you avoid fines or confiscation of funds. It also provides official documentation for the legal entry of cash into a foreign country, which is crucial if you plan to deposit the money into a bank account or use it abroad.

How to transport more than ,000?

You must complete a declaration at the border and provide the necessary supporting documents.

Why is legal assistance important for transporting funds abroad?

Legal assistance is essential for successfully and securely managing the transfer of funds abroad. Our firm has extensive experience dealing with both routine and complex cases involving the export of funds across borders. We pay special attention to urgent cases where speed and precision are critical. Understanding that every situation is unique, our lawyers offer personalized solutions tailored to your specific needs. Every approach we recommend has been proven effective through practical experience.

Our services cover all aspects of the process and offer additional benefits. With our international network of partners, we can help you:

- Verify the legal origin of your funds.

- Navigate tax optimization strategies, including those related to dual residency.

- Manage Controlled Foreign Corporations (CFCs).

- Address immigration matters.

We can also facilitate the remote sale of property, assist in selecting a foreign bank, and help you open an account abroad. We handle everything in one place, minimizing hassle, delays, and your direct involvement.

Most importantly, we stay by your side, even in the face of unexpected challenges, resolving any issues promptly so you can confidently achieve your goals. Contact us today, and we will guide you through the process, ensuring a safe and successful transfer of your funds!