Electricity Sales Accounting

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

When entering the market, electricity suppliers are faced with many uncertainties. The registration procedure is complicated, there are many segments of the wholesale market that need to be understood, and more.

For example, accounting in this area is complicated by the fact that there are many regulatory reports to be submitted to different agencies. We will talk about the taxes paid by an electricity supplier and the specifics of accounting for its activities in Ukraine.

You may also like: How To Buy Electricity In The Wholesale Market Of Ukraine?

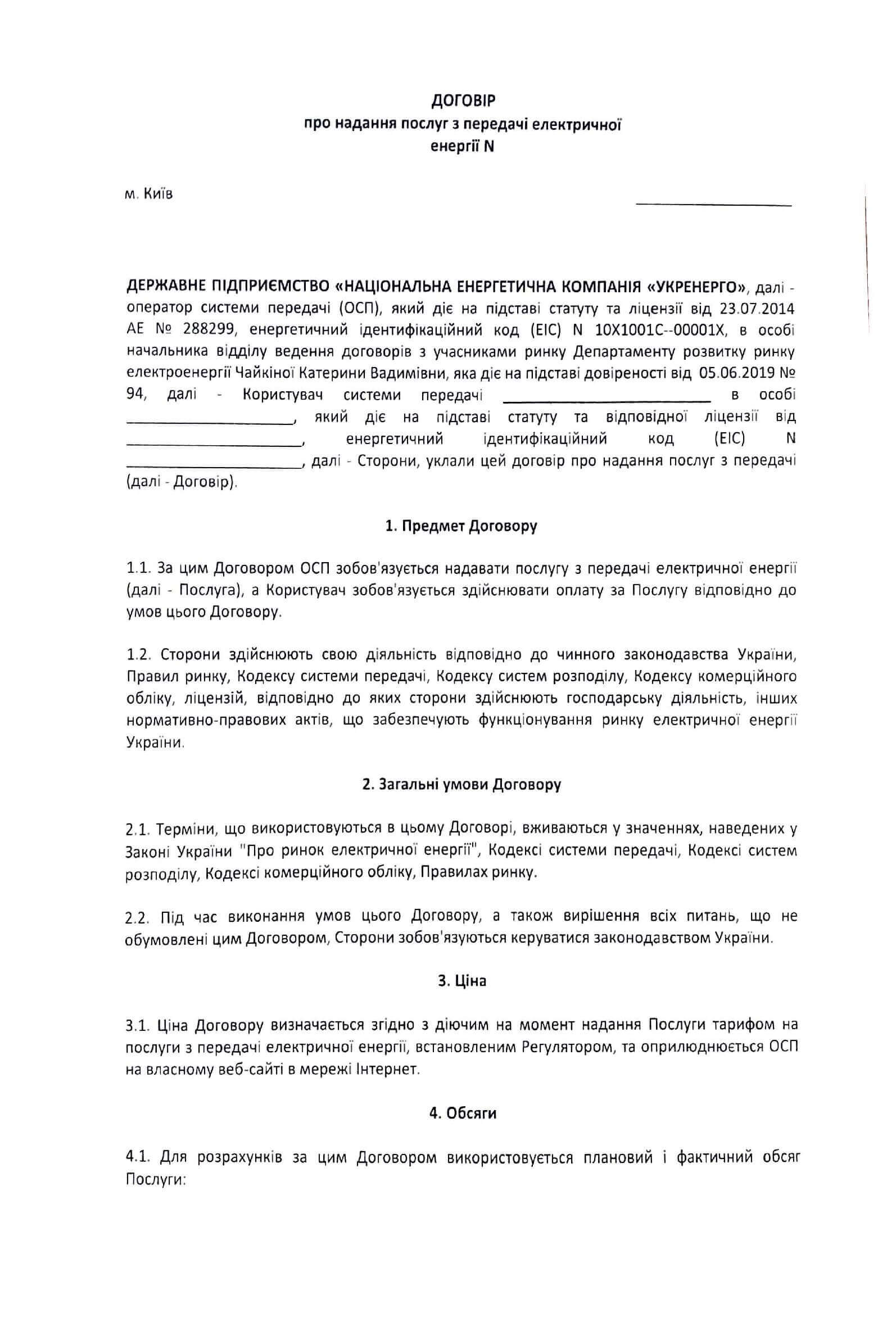

Where can you find information about accounting for electricity market participants?

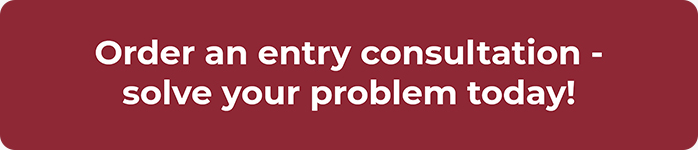

The key aspects of the suppliers’ activity are regulated by the Law No. 2019-VІІ “On Electricity Market”. However, an accountant can’t find much information in this Law, so, as in the case of other business entities, the main source of information is the Tax Code Of Ukraine (TCU).Let’s immediately name a few important aspects of taxation:

- if a company only sells electricity, but does not produce it, there is no need to pay excise tax;

- electricity suppliers cannot be single taxpayers, so accounting is kept under the general taxation system.

Useful material: Electricity Import And Export

What taxes does the electricity supplier pay?

The biggest and the most significant difference in the process of accounting of electricity supplier;s activity is the cash method for determination of tax liabilities on VAT and issuance of tax invoices.

What is the cash method? In simple words, it is when the date of tax liabilities is considered the date of receipt of funds to the cash desk or to the company’s account.

As for the moment of VAT accrual, VAT liabilities are accrued mainly on the first event: either delivery of goods/services or receipt of funds - depending on what happened earlier. Electricity supply is an exception that is explicitly stated in paragraph 187.10 of the Tax Code, which dictates the moment of VAT accrual.

As for accrual of other types of taxes, it is more or less standard situation here:

- Income tax is accrued in the amount of 18% of the profit determined under the accounting rules.

- If necessary, land or real estate tax is accrued. In case a company is an owner of a land plot, unit or real estate.

- Since the electricity supplier is only an intermediary between the producer and its consumer, it is exempt from excise duty, environmental pollution tax and rent payment. In the case of the producer, the excise tax is 3.2%. Pollution tax (environmental tax) is paid based on a formula specified in Article 249 of the Tax Code.

- Payroll taxes do not depend on the type of business activity or its form of ownership. In this part, electricity suppliers are no exception, and shall accrue and pay the full list of taxes: personal income tax, military fee, single social contribution. The rules for their calculation and payment are regulated by the TCU and the Law on the single social contribution.

Please note! According to the licensing regulations, all employees must be officially employed.

When organizing the accounting of an electricity supplier, it is necessary to know and understand the regulatory policy in terms of price formation, tariffs and markup percentage.

You may also like: Day-Ahead And Intraday Markets

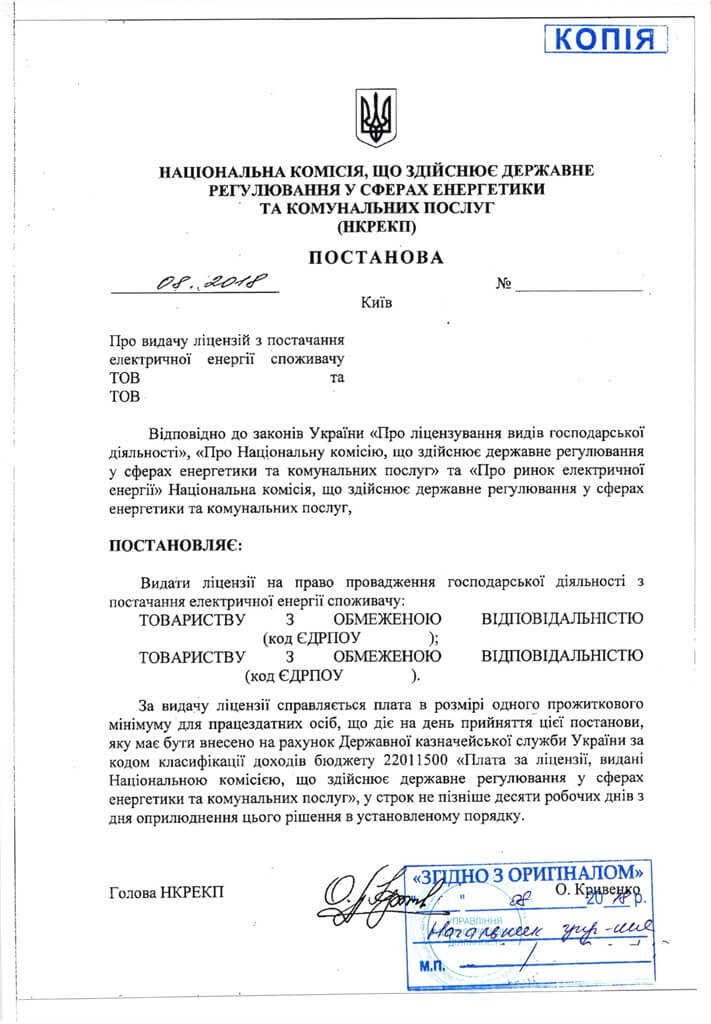

Please note that in addition to tax control there are also other agencies, which you should report to. For all companies, this is at least the statistical authorities, and for electricity suppliers, the regulatory authorities include also the National Energy and Utilities Regulatory Commission (NEURC), which shall be filed, for example, with the following documents:

- Report on the volume of purchased electricity;

- Report on contractual relations;

- Report on appeals and complaints from electricity consumers, etc.

If you want to make head of the accounting for an electricity supplier, don’t hesitate to call us. We will help you to organize the whole process.

Want to know more?

All information about obtaining a License to Sell Electricity.

All information about registration as an electricity market participant.

All information about accounting of business entities.

We are ready to help you!

Contact us by mail [email protected] or by filling out the form: