Import services by resident. Accounting and tax accounting

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

When your company works with non-residents that provide services to it, you will definitely encounter such a concept as import of services.

Import of services refers to the purchase of services by a resident from a non-resident regardless of the place of service delivery (on the territory of the resident or non-resident).

This concept is quite broad, as it includes many operations, from consulting to obtaining a comprehensive service or the right to view some information. This is the diversity that makes the import of services quite a specific operation.

In case of the service misunderstanding or improper execution of documents, companies often risk penalties when passing through FEA inspections. For example:

- incorrectly identified the place of service provision, resulting in failure to accrue VAT;

- the essence of the actually provided service does not correspond to the description in the documents confirming the performance of work (contract, act of work performed and others) - failure to accrue taxes in full;

- failure to provide the report on work performance, terms of reference or other documents that confirm the fact of work performance - unconfirmed expenses;

- failure to make adjustments to the financial result of the acquisition from a non-resident, which is registered in countries with low-tax jurisdictions - failure to pay income tax in full;

- and other.

All of the above examples confirm the necessity to carefully analyze the operations of import of services, and to correctly prepare the package of documents confirming the costs incurred and the transaction.

Since both a resident and a non-resident participate in the import of services, you can’t do without an international money transfer (in order to pay for services to non-residents).

You may also like: INCOTERMS in a Foreign Trade Contract

Payment features for service imports in Ukraine

Due to the current martial law in the country, there are restrictions on payment for services and the purchase of currency to pay for transactions related to the import of services.

Read more about the restrictions in more detail here.

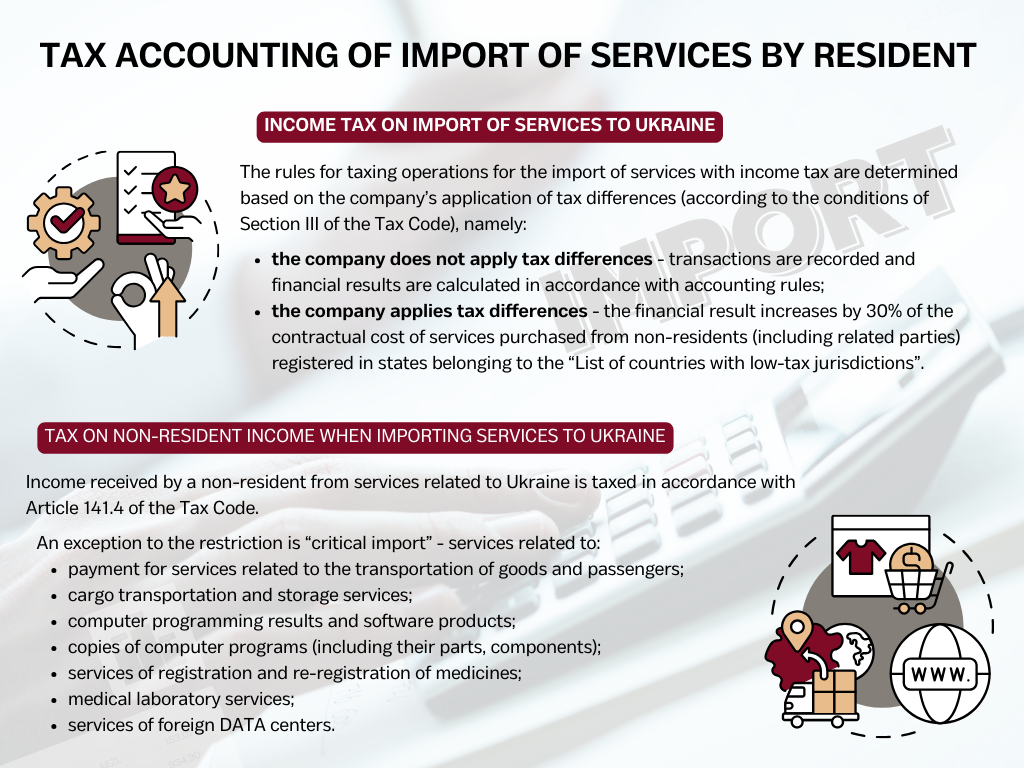

The exceptions to the restrictions are transactions that fall under the concept of “critical imports”.

Critical imports include services related to:

- payment for services related to the transportation of goods and passengers;

- transportation and storage services;

- computer programming results and software products;

- copies of computer programs (including their parts, components);

- services of registration and re-registration of medicines;

- services of medical laboratories;

- services of foreign DATA-centers.

Import of services is a foreign economic operation and is subject to currency control. Withdrawal of transactions from currency control and issuance of permits for buying foreign currency to pay for import contracts (including services) falls within the competence of banks.

Before signing a service import contract our specialists consult with the Client’s bank regarding the draft of the contract and the package of supporting documents (in order to reduce the risk of refusal to buy foreign currency or removal from currency control).

You may also like: Direct and Indirect Contract in Foreign Economic Activity

Peculiarities of service import accounting

Import of services is the same economic operation as the purchase of other services in Ukraine. Purchased services are included in the expenses of the company in accordance with national (international) accounting rules and accounting policy. All expenses of the company must be documented, and import of services is not an exception.

What documents should the company have to confirm the cost of importing services?

The basic package of documents needed (regardless of your activity and type of service) shall include:

- a service contract;

- an invoice;

- a completion certificate.

Depending on the service and its characteristics, it is necessary to document the reality of the work/services. For example (not limited to):

- For IT services: terms of reference for work, video recording of programming results, Beta-version of the application, etc;

- For registration/reregistration services: registration certificate.

- For medical laboratories: results of tests/studies.

- For conference and training services: event program, photo report.

- For training services: training program, manuals, test results.

If you are not sure that you have a complete set of documents to convince the regulatory authorities of the fact of work, please contact our experts who will conduct a prompt audit of your accounts, and help you solve the problem.

You may also like: Accounting and Tax Audit in Kyiv

Service imports and VAT

According to the law of Ukraine, the object of VAT taxation are operations that are supplied/provided on the territory of Ukraine. The Tax Code interprets the place of service supply as:

- the place of actual provision of services related to the property;

- the actual location of the real estate in carrying out services with real estate;

- the actual place of service provision in the field of culture, art, science, education, and other areas of activity in accordance with paragraph 186.2.3 of the TCU;

- place of registration of the business entity - recipient of services.

Let’s focus on Clause 4, according to which the place of service delivery is the place of registration of the resident, a recipient of the services. This clause applies to transactions related to:

- advertising services;

- consulting, legal, accounting, auditing services;

- software development and testing services;

- data processing and consulting services in the field of information;

- provision of proprietary intellectual property rights;

- creation and use of intellectual property rights;

- outsourcing/outstaffing;

- leasing or renting of movable property;

- telecommunication services;

- freight forwarding services;

- electronic services.

Please note! Electronic services are all services that can be provided over the Internet, including through an application on your phone, tablet, TV and other devices.

These services include (but are not limited to):

- provision of electronic publications;

- access to images/texts/videos;

- subscriptions;

- providing access to databases;

- providing distance learning;

- cloud storage;

- software and its maintenance;

- providing advertising services and other.

According to the Tax Code, if the recipient of the above services is a resident of Ukraine, he/she has an obligation to accrue VAT on transactions related to the receipt of services from a non-resident.

For example, a resident buys advertising services from a non-resident for the amount of ,000. In that situation, the resident has an obligation to accrue and pay 20% of VAT on the contractual value of services.

Please note! The obligation to pay VAT on the import of services arises regardless of the status of the VAT payer (whether the resident is a VAT payer or not).

Let’s discuss the procedure of charging VAT on import of services in details.

You may also like: Essential Terms of the FEA Agreement: How to Avoid Problems with Imported Goods Supplies?

If the recipient of services is a VAT payer

The resident accrues VAT obligations according to the rule of the first event (prepayment for services or an act of work performed).

The tax base is the contractual value converted into hryvnia equivalent at the rate of NBU on the date of obligation.

Accrual of VAT obligations shall be accompanied by:

- a tax invoice for the amount of purchased imports of services;

- inclusion of a properly completed and timely registered in the Unified electronic registry of tax invoices tax invoice in the VAT declaration.

In fact, the resident VAT payer hits zero, as a timely registered tax invoice for the import of services is simultaneously reflected in both VAT liabilities and tax credit.

If the recipient of services is not a VAT payer

Determination of tax liabilities when importing services by a VAT non-payer is identical to the scheme with a VAT payer.

The only exception is that a VAT non-payer does not issue a tax invoice and does not include it in the VAT declaration.

When importing services a resident (a VAT non-payer) is obliged to:

- Prepare assessment of VAT tax liabilities in connection with the receipt of services from a non-resident.

- Submit the assessment to the State Fiscal Service (office of Fiscal Services at the place of registration of the recipient of services) within 20 calendar days after the end of the reporting period in which such services were provided (for example, the service is provided on September 5, VAT assessment for September must be submitted until October 20);

- Pay VAT to the budget until the 30th day of the month following the accounting period in which such services were provided (for example, the service is provided on September 5, VAT shall be paid until October 30).

You may also like: VAT Payment and Refund Methods in the EU in 2022

Income tax on import of services to Ukraine

Income tax rules for the import of services are determined based on the application of the company tax differences (under the terms of Section ІІІ of the Tax Code of Ukraine), namely:

- the company does not apply tax differences - accounting of transactions and calculation of the financial result is carried out in accordance with the accounting rules;

- the company applies tax differences - the financial result is increased by 30% of the contractual value of services purchased from non-residents (including related persons) who are registered in the states on the “List of Countries with Low Tax Jurisdiction”.

You may also like: New Rules for Application of Double Taxation Treaties

Non-resident’s income tax on import of services

Income received by a non-resident from sales originating in Ukraine is subject to non-resident income tax by Article 141.4 of the Tax Code of Ukraine.

In terms of the import of services, such taxes shall be imposed on:

- freight and revenues from engineering;

- operating leasing / rent;

- income from joint activities on the territory of Ukraine (including provision of services in joint activities);

- remuneration for carrying out cultural, educational, scientific, religious, sports and entertainment activities on the territory of Ukraine;

- insurance payments;

- commissions and brokerage fees.

Tax on the income of a non-resident is withheld from the contractual value and paid to the budget by the tax agent (resident).

The main mistakes that businesses make when importing services

Here is an example of a client’s mistake, which we identified during express audits of tax accounting.

The case “Payment by a resident for training services abroad”.

The actual training service was provided to the employees of the Ukrainian company by non-residents abroad. Our audit consisted of several stages.

Step 1: Checking of documentary evidence of expenses.

During express audit client provided:

- a training contract;

- a training program;

- an act of completed work;

- a copy of methodical recommendations;

- an order for the company to conduct a training (with a list of employees who undergo it);

- documents on business trips of employees who underwent training.

In terms of confirmation of expenses in accounting and tax accounting, the package of documents provided by the client fully confirms the purposefulness of expenses and a direct link to the business activities of the company.

Result: No remarks found.

Step 2: Checking compliance of a non-resident with the status of a taxpayer of countries with low tax jurisdictions.

The non-resident that provided the service to our client is a resident of Germany, which is not included in the list of low-tax jurisdictions.

Hence, the transaction does not require a 30% increase in the financial result of the service.

Result: No remarks found.

Step 3: Checking the correctness of VAT calculation.

According to the documents provided by the client, the transaction was considered in terms of providing training services. The place of rendering education services by a non-resident is the place of actual rendering of services, which is the territory of Germany. In this case, the object of VAT taxation does not arise.

However, at the time of the audit of payment to the non-resident, it was revealed that the purpose of payment contained the following information “Payment for information and consulting services under supplementary agreement”.

The supplementary agreement (initially not provided by the client), according to which the payment for services was made, contained information on the change of the subject of the service from “Staff training” to “Provision of information and consulting services”.

According to the Tax Code, when information and consulting services are rendered by a non-resident, the place of rendering such services is the place of registration of the service recipient, in our case it is Ukraine. In this connection, the cost of the service is subject to VAT payment.

In this situation the client:

- did not charge VAT on the contractual value of the service - USD 5K * 36,5686 * 20% = 36 UAH 568,60;

- did not issue and did not register the tax invoice (for the period of quarantine there are no penalties for late registration of the tax invoice);

- failed to include the tax invoice to the liabilities under the VAT declaration. Penalty for self-declaration of VAT error is 3% of amount of undeclared liability (36,568.60 *3% = UAH 1,097.06).

If your company intends to buy services from a non-resident, we recommend that you calculate the taxation of the transaction before the transaction.

This will help not only to avoid penalties if you “miss” some tax issues but also to calculate more favorable payment options.

More about audit and its benefits here.

Our clients