How can a foreigner inherit real estate in Ukraine?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Today it is a common situation to have family members scattered all over the world, and you can find your relatives living thousands of kilometers away. The tendency to migrate, to look for a new place of residence, the ability to move easily between borders leads to the fact that even the closest relatives may have different citizenship and live in different countries.

Difficulties arise when a citizen of one country applies for an inheritance in another country. Thus, for example in Ukraine, foreigners whose relatives or close friends have died, are faced with the need to not only understand where and how to apply for inheritance, but also with some inconveniences in the process.

Several services, institutions and officials are involved in the process of receiving an inheritance by a foreigner. And this means that the foreigners need to correctly calculate their time in Ukraine. No one wants to waste extra time and money, even for the sake of inheritance.

Of course, both the procedure and the complexity will depend on many factors, such as whether you have documents for residence in Ukraine, the degree of kinship and many others.

Today, we will talk about the situation when a foreigner inherits real estate in Ukraine: how to formalize the right to such an inheritance? What to do with it then? If you're not just looking for information but also need legal support to handle inheritance matters in Ukraine, don’t hesitate to contact us. We offer a service that can fully facilitate the inheritance process remotely through a power of attorney arrangement, including taking care of tax payments. You'll receive comprehensive assistance from our expert, who will be in constant communication with you, and a clear plan focused on ensuring a safe and convenient inheritance experience. We handle the entire process from start to finish, working with reliable notaries, translators, and experts. Additionally, we will guide you on how to manage your inherited assets in the future.

You may also like: Registration of Ownership Rights in the Electronic Register

What is the peculiarity of inheriting real estate in Ukraine by a foreigner?

The main feature is the package of documents that the heir must provide to the notary, as well as the tax rate that must be paid for the inherited real estate.

So, real estate, which is located in the territory of Ukraine can be inherited by citizens and foreign persons living at the time of death of the testator as well as those who were conceived by the testator during his/her lifetime and were born alive after his/her death.

You may also like: How Can a Foreigner Sell an Apartment in Ukraine?

Inheritance (real estate) registration procedure in Ukraine for a foreigner

Let's divide the whole procedure into several stages.

Preparatory stage:

At this stage it will be necessary to make all the steps that, first, will make it possible to receive the inheritance, and secondly, will activate the procedure. You should start with the registration of the power of attorney to the representative in Ukraine, if you do not plan to stay in Ukraine for more than six months or to go independently to all state and non-state bodies. Also, this stage involves the following steps:

- filing (or sending) an application for acceptance or rejection of inheritance;

- establishment of the heir’s turn of succession by the notary in accordance with the law;

- receiving and submitting to the notary a package of documents from the heir;

- obtaining a tax identification number for a foreigner;

- real estate appraisal.

The start of the process is the submission of an application for acceptance of inheritance. Such an application for acceptance of inheritance is submitted by the heir personally at the notary in Ukraine. Unfortunately this also applies to the wartime period – you will need to personally visit the notary’s office and submit an application or send it by registered letter by post. The lawyer will be able to arrange such an appointment for you and accompany you in the process.

Since non-residents have permanent residence abroad, the place of opening of the inheritance (and therefore the location of the appropriate notary), is the location of the real estate or the main part of it.

A period of six months is established for accepting inheritance, starting from the time of opening of the inheritance. During martial law, this period is “frozen"” and will start counting only after the end of hostilities.

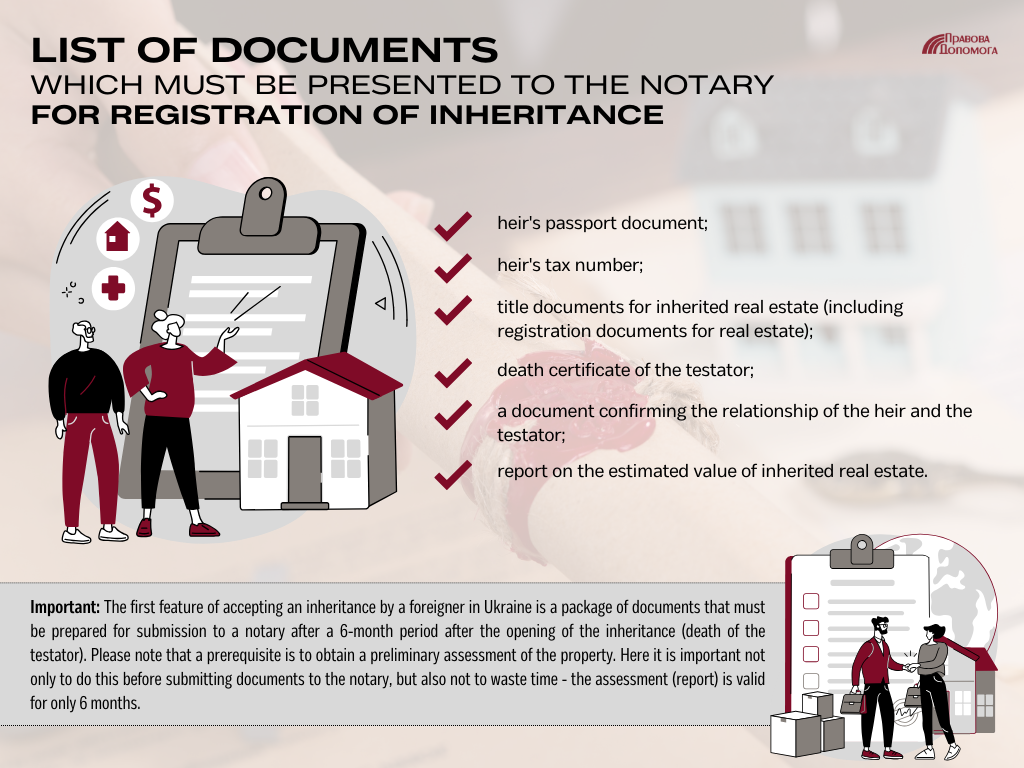

The package of documents to be submitted to the notary for inheritance is as follows:

- the heir’s passport document;

- tax identification number of the heir;

- title documents for the real estate to be inherited (including registration documents for the real estate);

- death certificate of the testator;

- a document confirming the kinship of the heir and the testator;

- report on the appraised value of the real estate to be inherited.

The first peculiarity of acceptance of inheritance by a foreigner in Ukraine is a package of documents, which must be prepared for submission to a notary after the expiration of 6 months after the opening of the inheritance (death of the testator).

You will need a TIN for receiving inheritance and its further use. Please check the procedure for obtaining a TIN here.

It’s worth paying attention to the prerequisite: you must get a pre-assessment of the property. It is important not only to make it before submitting the documents to the notary, but also to not miss the time - the assessment (report) is valid for only 6 months.

All necessary documents (birth certificate, decision (certificate) of divorce, other documents), must be legalized in accordance with international law, translated into the official language and certified by a notary.

Of course, since a foreigner will be providing documents that he/she received abroad, they will need to be certified in the manner specified by law. The ways of certifying the authenticity of documents issued by a foreign country are described here.

Subsequent procedure: receiving and registration of inheritance in Ukraine

The stage of release of inherited property.

The term of opening of inheritance is the day of the person’s (testator’s) death or the day on which he/she is declared dead.

At this stage:

- the notary draws up and sends an inquiry to the Technical Inventory Bureau on who the real estate is registered to and in order to obtain the relevant registrations;

- all taxes, fees, mandatory payments, administrative and notary fees are calculated and paid.

Please note! The Technical Inventory Bureau may in some cases incorrectly indicate the following information:

- shares of immovable property;

- information regarding the address where the heirs’ real estate is located, etc.

You can get, for example, incomplete information. That is why you must carefully check all information, and keep constant communication with the TIB.

This stage takes more than six months from the opening of the inheritance to the beginning of the registration stage. The law provides a period of 6 months from the death of the testator so that all heirs can declare their rights to inheritance.

Inheritance registration stage.

Following the 6-month period after the opening of the inheritance, the heir needs to submit another application to the notary-registrar for the issuance of the inheritance and the registration of ownership rights in the electronic register. In this case, for example, if you inherit a plot of land and a house on it, you will need to submit one application.

The notary prepares and prints out the application in two copies, which the applicant (provided there are no comments to the information stated in it) must sign.

One copy of the application shall be provided to the applicant and the other shall be attached to the documents submitted for the state registration of rights.

After that the notary registers the application in the application database. The moment of application acceptance shall be the date and time of its registration in the application database. The registration file shall be sent by the notary to the archive.

You may also like: Can a Foreigner Offer His Apartment for Rent in Ukraine?

Taxation of inheritance in Ukraine for a foreigner

After all the necessary documents are received by the notary and before the issuance of the certificate of right to inherit the property, the heir must pay taxes.

This is the second peculiarity of inheriting real estate by foreigners.

If the heir does not reside permanently in Ukraine, or has a permanent place of residence in another state, its residency is determined by the state with which he/she has closer personal or economic ties. If it is impossible to determine this and the heir has no permanent place of residence in any of the states, he/she is considered a resident if he/she stays on the territory of Ukraine for at least 183 days during one year.

Please note! Citizenship of Ukraine or a temporary residence permit does not determine a residence status.

So, when inheriting real estate the non-resident heir must pay taxes amounting to 18% of the appraised value of the property to be inherited, and an additional 1.5% military fee. Only if there is a document confirming these payments, the notary will be entitled to issue the documents of title to the real estate.

Coming into an inheritance is a long-term process that requires repeated involvement of a non-resident heir, attention and detailed review of documents that are provided by state authorities and issued by a notary.

Our team will thoroughly gather and check all necessary documents for completeness and absence of mistakes/errors in them, necessary for you to receive real estate by inheritance.

We will help to resolve disputes with other heirs, and assist in obtaining an inheritance at a time of unstable work of notaries in Ukraine.

Didn’t find an answer to your question?

Everything about receiving inheritance in Ukraine by a foreigner here.

Our clients