Managed to close foreign representative office in Ukraine in 8 months

Cost of services:

Reviews of our Clients

In the first decade of 2016, a head of the foreign company representative office in Ukraine contacted our company for legal support and assistance in liquidation of the foreign company representative office in Kyiv.

The Client’s case had two peculiarities. First, the parent company required to dismiss the head of the representative office and to appoint one of our employees as a liquidator of the representative office. Second, the liquidation process had to take no more than 8 months.

The first Client’s requirement wasn’t difficult to fulfill, as our company has specialists with an appropriate expertise and good knowledge of English. But it was a bit more complicated to handle the representative office liquidation within eight months.

According to the regulations applicable at that time, to close a representative office, one shall pass an audit by the State Fiscal Service of Ukraine (SFS) and obtain a certificate of deregistration (Form 12-OPP). In fact, the authority to perform audits was transferred from the territorial offices of the SFS in Kyiv to the Kyiv City Audit Department of the SFS. This meant that a dozen inspectors had to process about 27,000 applications for the liquidation of businesses, firms, representative offices and so on. Whereas previously, it took more than a year to get the audit scheduled, it couldn’t be even assumed what would happen after the redistribution of authority.

We also realized that the period and quality of the audit would also be affected by the fact that the representative office reported to the territorial office rather than to the Kyiv City SFS. The inspector would have to request all the necessary documents for the audit from the territorial office of the SFS that would take some time. Another challenging stage was a new procedure for signing the online checklist, where we played a major role of pioneers.

Nevertheless, we have extensive experience of closing foreign company representative offices and legal entities. Thus, after thorough assesment of all facts, we decided to accept the Client’s requirements. In May 2016, the company’s lawyer was appointed the head of the foreign company representative office.

Thanks to rich experience and expertise of the company’s lawyers, we managed to set a pre-liquidation audit of the foreign representative office performed by the State Fiscal Service of Ukraine within two months following the filing date of the application. The audit aided by the Client’s accountants was performed within two weeks and didn’t result in any penalties or fines.

It should be noted that when signing the checklist it became clear that the audit wasn’t thoroughly performed by the SFS employees, and we found a small underpayment of the unified social security contribution and a significant overpayment of income tax. These circumstances significantly delayed the signing of the checklist, which was required to obtain the certificate of deregistration (Form 12-OPP) from the State Fiscal Service of Ukraine.

It is also worth noting that one of the documents required for liquidation of a representative office is a deregistration certificate from the customs authorities. We obtained this document well in advance. Imagine our surprise when during signing the checklist it was found out that the representative office wasn’t deregistered at the State Customs Service of Ukraine. Within the specified period, the Customs Service was subordinated to the State Fiscal Service of Ukraine, and when we asked them to clarify the situation, as we had a sealed document verifying the representative office deregistration, they replied that our documents were not signed by the relevant department and they prepared a certificate, but didn’t actually deregister the representative office.

All the abovementioned facts clearly show that the reforms, in particular tax reforms, are ill-considered and lead to many inconsistencies and incompetent actions that have never existed before.

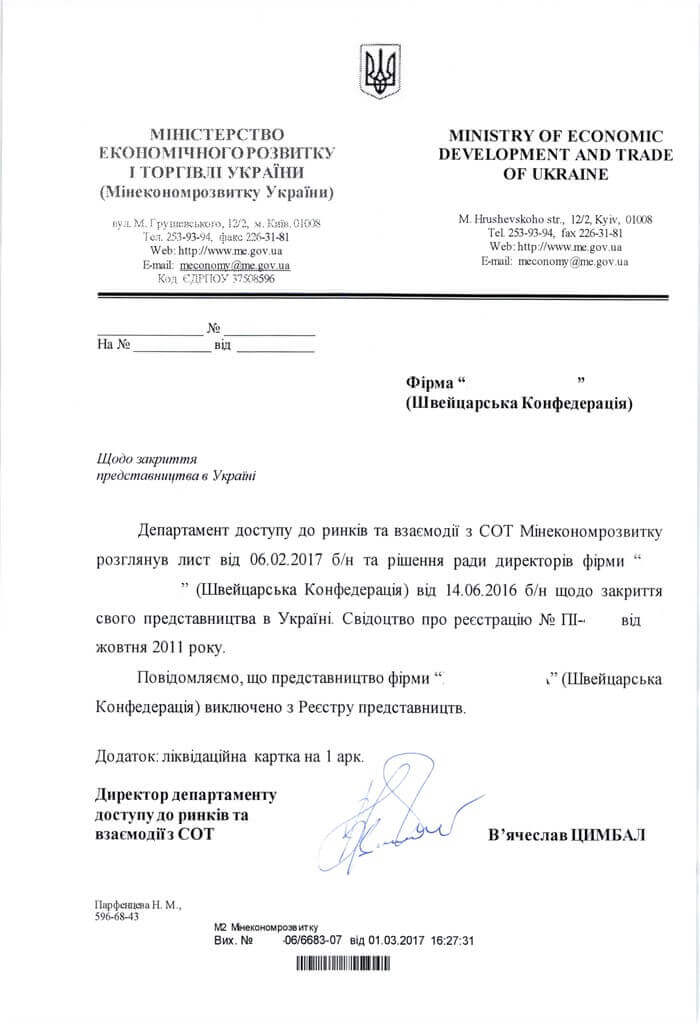

Thus, the technical stage was the most time-consuming, though we didn’t expect to spend so much time for that procedures. Nevertheless, after successful obtainment of the deregistration certificate (Form 12-OPP), our lawyers completed all the necessary procedures at the Ministry of Economic Development and Trade of Ukraine and State Statistics Service within the stipulated time frame.

To learn more about the cost and term of the representative office liquidation click here.

Our clients