Charitable foundation: how to establish? Our experience in Ivano-Frankivsk Region

Cost of services:

Reviews of our Clients

In August 2019 our firm received a request of a Client from Ivano-Frankivsk region who wanted to register a charitable organization. He/she did not know where to start, so he/she needed advice on the procedure and further activities of the organization and he/she also asked to develop a charter and other papers.

Our employees immediately gave a warning that he/she would have to submit the papers in the Ivano-Frankivsk region in person, since we do not have partners in all the regions. However, we could develop constituent documents and provide detailed instructions on what to do and where to submit them.

Related article: Our lawyers registered a charity aimed at the protection of homeless animals

Our Service

First of all, we held a consultation, during which we answered the following questions of the Client:

What type of a charitable organization is better to choose?

Although there are three types of charitable organizations (a foundation, an institution and a society), the vast majority of charitable organizations in Ukraine are established in the form of a foundation. Therefore, some even identify these concepts, as if a charitable organization and a charitable foundation were one and the same.

A charitable institution is a type of a charitable organization , the founders of which transfer their assets to achieve the goals of charitable activities. The specifics of charitable societies are generally very little disclosed by law. However, a charitable foundation is the most suitable, perhaps, for 99% of those wishing to do charity work. It was on this option that our Client decided to stop with.

Related article: Registration features of charity organisations and foundations

Can he/she be the sole founder and leader of the organization?

In a charity foundation, one founder is sufficient, who can also be the head of his foundation. Than is unlike charitable societies, where there should be at least two founders.

What reports of a charitable foundation (organization) should be submitted and how often?

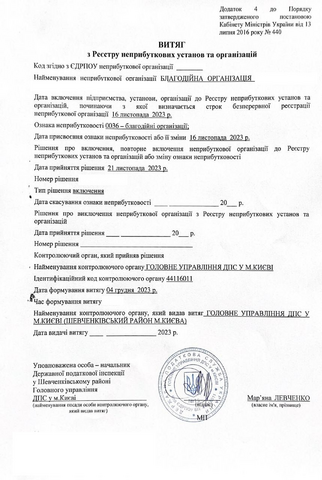

Charitable organizations, if they have the status of non-profitability, submit a report on the use of income (profit) once a year. Regardless of the status of non-profitability, the following documents are to be submitted:

- The ledger - to the local statistical office - once a year;

- if an employment relationship with employees is drawn up - salary reports are to be submitted once a month.

Related article: Is it possible to obtain a license for implementation of a specific kind of economic activity for public organization or charity foundation?

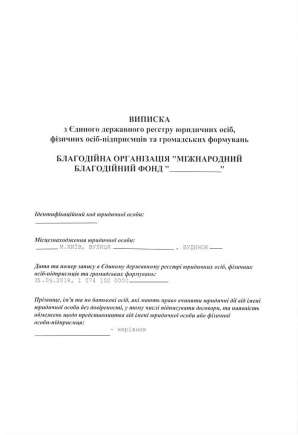

After consulting and concluding an agreement on the provision of legal services, our specialists developed for the Client the following list of documents:

- A charter of a charitable foundation;

- A decision to create it;

- An application for the registration of a charitable foundation;

- An application for adding it to the register of non-profit organizations.

We also explained how to properly sew together the charter and get it notarized and provided instructions on where to submit the papers.

The Client correctly understood the instructions and handled everything perfectly. Therefore, he/she had a charitable foundation ready for work in a short while.

Related article: Registered a charity foundation without a presence of Client

We also want to direct your attention to the fact that for those who do not want to spend time on the procedural moments of registration, we offer to buy a ready-made charitable foundation from our company.

For all other issues regarding the establishment of a charitable foundation in Ukraine, please contact our specialists.

We are ready to help you!

Contact us by mail [email protected] or by filling out the form: