The new law on charity in Ukraine: Opportunities, Perspectives and Risks (2013)

Cost of services:

Reviews of our Clients

Partner of law firm “Pravova Dopomoga” Volodymyr Gurlov wrote an article about new Law of Ukraine “On charity activity and charitable organizations” for Kontrakty.UA. The article is based on firm’s experience of registration and provision of legal support for charitable organizations in Ukraine.

It is available on website of the portal under the link http://kontrakty.ua/article/59266.

Unabridged text of the article (translation):

A new law “On charity activity and charitable organizations” entered into force on the 3rd of February 2013. This document significantly simplifies the procedure of state registration for charitable organizations, provides stricter requirements for management of the organizations and extends opportunity to use ones in tax optimization.

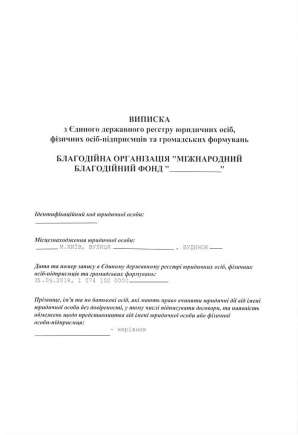

From now on state registration of charitable organizations will be performed the same way as state registration of enterprises. Thus, it will be performed not by bodies of the Ministry of Justice of Ukraine like it was before but by state registrars in accordance with the law of Ukraine “On state registration of legal entities and sole proprietorships”. Due to this the term of state registration of charitable organizations will be shortened from 2 months to 3 business days including time for the registration, without taking into consideration the time for registration with bodies of State Tax Service, Pension Fund and Ukrainian State Statistics Service. Besides, the list of documents which are required for the registration was shortened (in particular it is no more required to submit information about founders of a charitable organization and members of its executive body, information about branch offices) and as the result the risks of registration denial have been decreased.

It is also worth mentioning that territorial status of charitable organizations has been cancelled. In order to conduct activities on all-Ukrainian level it is no more required to create branch offices in majority of regions of Ukraine.

But while pursuing simplification of charitable organizations’ activities the legislator also cancelled provisions which obstructed misuse of activities results of charitable organizations.

Thus, a prohibition of charitable organization’s property and funds formation by loans and a prohibition of funds and property use as collateral have been abolished. As the result, it is quite possible to apply a scheme under which a charitable organization can take a loan from an enterprise or a bank and use the collected charitable donations as collateral. So when the loan due date comes an enterprise will be able to collect property of a charitable organization including the donations.

Charitable organizations most likely will be entitled to become a guarantor or mortgagor in loan contracts, making loans and credits from donations. This is due to the fact that Section 2 of Article 23 of the law on charity prohibits such actions only regarding members of charitable organization’s management board. This provides an opportunity to make loans and credits to other persons.

The new law does not provide requirements for a receiver of charity to be a person in need of such. Previously such requirement was included to the definition of charity receiver. From now on the receiver can get charity for any lawful purposes in all fields of charitable activities. At the same time the latter include in particular stimulation of economic growth and development of economy of Ukraine and its particular regions as well as increase of Ukrainian competitiveness. Thus, from now on charitable organizations can provide charity to enterprises which is aimed at economic growth and competitiveness.

The new law also does not include requirements about accounting of funds for economic and charitable activities that are on separate bank accounts. Attention should be drawn to provisions of Section 2 of Article 6 of the Law that allow a philanthropist to get back the funds of charity grant in the form of refundable financial aid if such grant was not used in accordance with its intended use during the term defined by the charity. This may help one to withdraw funds temporarily in order to reduce tax obligations during a certain accounting period with further return of these funds.

Prohibition of charity provision to political parties or on behalf of political parties as well as prohibition of participation in pre-election campaign looks quite declarative comparing to the abovementioned opportunities of charitable organizations use:

- Nothing hinder to provide a charity to another legal entity which will fund a political party in its turn;

- There is no prohibition of charity provision to voters on candidate’s for presidency or an MP position behalf as well as directly for a candidate for presidency or an MP position;

- Along with introduction of this prohibition the legislator repealed a prohibition for charity activities conduction by the President, MPs, public officials and officers of state bodies and local authorities within limits that exceed their declared incomes.

Stricter requirements for management of charitable organizations are most likely intended to remove such misuse.

Thus, new legislation limits organizational and legal forms of charitable organizations by allowing establishing them only in the form of charitable association, charitable foundation or charitable establishment and defining peculiarities of their management. In particular a charitable association must be established by at least two founders. Charitable foundation and charitable foundation require one or two founders. At the same time a peculiarity of a charitable foundation is that its members are not obligated to transfer any assets to it in order to reach goals of charitable activities while a charitable establishment on contrary is founded by assets which are provided by one or couple of founders in order to reach charity goals by means of these assets and/or revenues obtained from them.

Also the Law provides requirements for entry into agreements which are of interest for members of management board. In particular member of charitable organization management board cannot make decisions about agreements or other legal bargains between a charitable organization and this member or a person related to him or her. Besides participants (founders) and members of charitable organizations’ management boards cannot be a beneficiary party (receivers of charity). But:

- The legislation does not provide clearly the consequences of entry into agreements with violations of these prohibitions (thus, these agreements will be appealable) and who will be able to appeal against such agreements (most likely this function will go to tax authorities);

- It is unclear whether founders and/or participants belong to members of charitable organization’s management bodies. On the one hand general meeting of participants is also called a management body but on the other Section 4 of Article 23 of the Law distinguishes terms of founders (participants) and members of charitable organization’s management body.

The abovementioned unclear legislative regulations may have critical consequences. This is due to the fact that in accordance with Section 2 of Article 27 of the law it is possible to terminate activities of any charitable organization through court proceedings initiated by a lawsuit of any interested person if use of its assets violates the Law’s provisions during the period of at least 12 months. Taking into consideration the fact that Ukrainian legislation does not provide clear requirements of assets use and interested person may be represented by any person, we have a situation when a constant threat of coercive liquidation is just like a sword of Damocles which hangs over charitable organizations.

If you have any questions, feel free to contact our Kiev law office.